SME lending plans move forward

eolas examines government plans to increase bank lending to SMEs.

eolas examines government plans to increase bank lending to SMEs.

“The SME sector will play a key role in Ireland’s continued economic recovery and it is essential that viable companies have access to credit to enable them to grow and meet their full potential,” said Finance Minister Michael Noonan in July.

Despite government pledges to increase lending to small and medium sized enterprises (SMEs), Central Bank statistics show that lending to non-financial, non-property related SMEs by Irish banks declined by €217 million in Q1 2012 (0.8 per cent), and by €1.7 billion between March 2011 and March 2012 (6.3 per cent).

The total outstanding amount of lending to those SMEs at the end of Q1 2012 was €27.1 billion. When the financial and property sectors were included, this totalled €61 billion.

New lending, which excludes lending related to restructuring or renegotiation of existing facilities, came to €407 million during Q1 2012, with SMEs in the agriculture sector accounting for 30 per cent (€125 million).

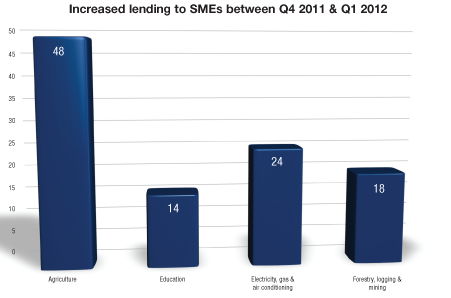

However, lending to SMEs increased in four sectors during the first quarter: agriculture (€48 million); electricity, gas, steam and air conditioning supply (€24 million); forestry and mining (€18 million); and education (€14 million).

The bank’s Governor, Patrick Honohan, has claimed that credit conditions for SMEs are tougher in Ireland than anywhere elsewhere in the euro area both in terms of cost and availability.

A report by two Central Bank economists, Sarah Holden and Fergal McCann, has found that rejection rates for SME loan and overdraft applications in Ireland (24 per cent) are the second highest in the euro zone area after Greece (41.6 per cent). It also found that Ireland has the second highest rate of discouraged borrowers (14.8 per cent) i.e. those not applying for loans for fear of rejection.

These findings were refuted by the Irish Banking Federation which pointed to the SME lending survey commissioned by the Department of Finance as “the definitive report.” Conducted by Ipsos MRBI and Mazars, it found that SMEs were still experiencing difficult trading conditions, and those with less than 10 employees reporting that they had experienced a decrease in turnover in the past six months.

The survey consulted 1,505 SMEs between October 2011 and March 2012 and found that there had been a 2 per cent increase in requests for credit from the rate of 36 per cent in September 2011. Requests for non-bank finance (i.e. government support, friends, family and business partners) had increased from 11 per cent in 2011 to 19 per cent in the six months to March 2012.

Sixty-two per cent of the SMEs had not requested credit in the preceding six months; 78 per cent because they did not need it and six per cent because they feared rejection. Most of the demand was for working capital or cash flow rather than for expansion, SMEs said. The authors point to the standardisation of the credit application process (see eolas issue 8, pages 26-27) as being helpful to those fearing rejection and point out that SMEs must be made aware that a rejected application does not result in a negative ICB rating.

Of the 23 per cent of credit applications that were declined, 81 per cent did not agree with the reason provided by the bank. However, 71 per cent of SMEs were aware that they could appeal the bank’s decision at the Credit Review Office.

John Trethowan, the office’s credit reviewer, has commented that the two pillar banks (Allied Irish Bank and Bank of Ireland) “are supporting low risk new lending proposals from well-established SMEs and farms.” However, he was disappointed that there isn’t more support for ‘enterprise risk taking’ on new and increased lending in the banks’ current lending policies.

Irish Times economics editor Dan O’Brien has pointed out that at the beginning of 2003 property developers owed banks €16 billion. That had risen to €106 billion in 2008. However, lending to the ICT sector (which has consistently had the potential for growth) only grew by

€350 million during the boom. Lending priorities were “insanely skewed,” O’Brien concludes.

The Central Bank’s June 2010 report, ‘Banking Supervision: our new approach’ outlined how banks were to move away from their concentration on property lending. It said that skills must be developed and that banks must consider contract staff, secondees from professional firms and staff exchange with other international regulatory authorities.

The pillar banks each face a target of lending €3.5 billion in 2012 and €4 billion in 2013. Trethowen has said this may prove difficult for them.

The Credit Guarantee Act was signed on 18 July, allowing for the Government to provide a 75 per cent guarantee to banks against losses on qualifying loans to job-creating firms.

A Microenterprise Loan Fund Bill was published before the summer recess and is expected to be passed in the autumn. The fund will see the Government lending to start-ups, sole-traders and existing micro-enterprises (employing no more than 10 people), which have been declined credit by the banks.

Commenting on the above initiatives, Trethowan said: “They will be useful additional tools in the SME spectrum but neither will be the ‘silver bullet’ to solve the supply of credit to SMEs.” That silver bullet, he suggests, is when domestic consumption rates recover and people regain the confidence to start spending money in the economy.

Employers group IBEC welcomed the two initiatives (when they were announced in the February Action Plan for Jobs). However, it adds that a roll-over relief (available in the UK) should be implemented for non-property enterprises, whereby proceeds from a business sale are not subject to capital gains tax if they are re-invested in an approved enterprise.

The Irish Small and Medium Enterprises Association is calling on the Government to also implement a ‘strategic investment bank’ to introduce competition.

| Credit advanced from Irish banks to SMEs (€ million) | ||||

| March 2011 | March 2012 | |||

| Sector | Outstanding amounts | Annual growth % | Outstanding amounts | Annual growth % |

| Business & administration | 2,565 | -2.5 | 2,587 | -9.4 |

| Community & social services | 1,886 | -4.5 | 1,866 | -5.0 |

| Construction | 2,250 | -2.1 | 1,962 | -11.3 |

| Education | 284 | 2.8 | 412 | -8.1 |

| Electricity, gas & air conditioning | 224 | 17.5 | 165 | -4.0 |

| Hotels & restaurants | 6,279 | -13.0 | 5,936 | -3.6 |

| Human health & social work | 1,379 | -17.9 | 1,347 | -2.3 |

| Information & communication | 195 | -1.3 | 176 | -11.9 |

| Manufacturing | 1,979 | -8.9 | 2,263 | -6.6 |

| Primary industries* | 4,721 | -6.3 | 4,490 | -7.3 |

| Real estate | 17,580 | -15.6 | 32,004 | -2.9 |

| Transport & storage | 954 | -15.8 | 963 | -10.2 |

| Water, sewerage & waste | 32 | 270.6 | 12 | -62.5 |

| Wholesale, retail trade & repairs | 6,513 | -8.9 | 6,836 | -6.8 |

| Total | 46,840 | -11.3 | 61,019 | -4.9 |

*Agriculture, forestry & quarrying

Source: Central Bank