Incentivising retrofit through Ireland’s tax system

Urgent policy intervention is needed to decarbonise construction at the scale required to achieve Ireland’s net zero targets by 2050, writes Joseph Kilroy, Policy and Public Affairs Manager for Ireland, Scotland and Wales for the Chartered Institute of Building (CIOB).

The built environment accounts for 37 per cent of Ireland’s carbon emissions. Heating, cooling, and lighting buildings – operational carbon – accounts for 23 per cent of national emissions, with the remaining 14 per cent attributable to embodied carbon. Embodied carbon results from mining, quarrying, transporting, and manufacturing building materials, in addition to construction activities, the repair, renovation, and final disposal of buildings.

Under Ireland’s current tax structure, a reduced rate of 13.5 per cent VAT is applied to demolition projects, creating a perverse environment where the embodied-carbon-hungry activities of demolition and replacement enjoy financial parity with the sustainable repair and restoration of Ireland’s built environment. This contradicts the principles outlined in the Circular Economy Act 2022, the Climate Action Act 2021, and the EU Taxonomy Regulation 2020 – an EU-wide classification system for sustainable activities.

To remedy this, the CIOB is proposing that the Government uses the tax system to incentivise the repair and restoration over the demolition of buildings, thereby reducing the embodied carbon footprint of Ireland’s built environment.

Specifically, we are calling for demolition to be charged at the standard rate of 23 per cent VAT, while repair and renovation activities remain at the reduced rate of 13.5 per cent.

Rather than incentivising sustainable construction activities such as add, transform, and reuse, Ireland’s VAT structure is facilitating a culture of demolish and replace. New-build projects are an essential component of the built environment, but, from a sustainability perspective, the replacement of buildings should not be given taxation parity with repair, as retrofit buildings will often outperform new ones in terms of overall lifetime carbon emissions.

Internationally, regulatory measures have proven effective in undergirding similar types of sectoral culture shifts from demolish and rebuild to repair and reuse. Landfill taxes and the application of an aggregate levy facilitated a 70 per cent decline in the amount of construction and demolition waste (CDW) disposed to landfills in the UK. Research in Spain has concluded that levies were more effective at CDW mitigation than financial incentives, achieving the targeted 30 per cent reduction in CDW two years sooner than expected and have the co-benefit of generating a new revenue stream.

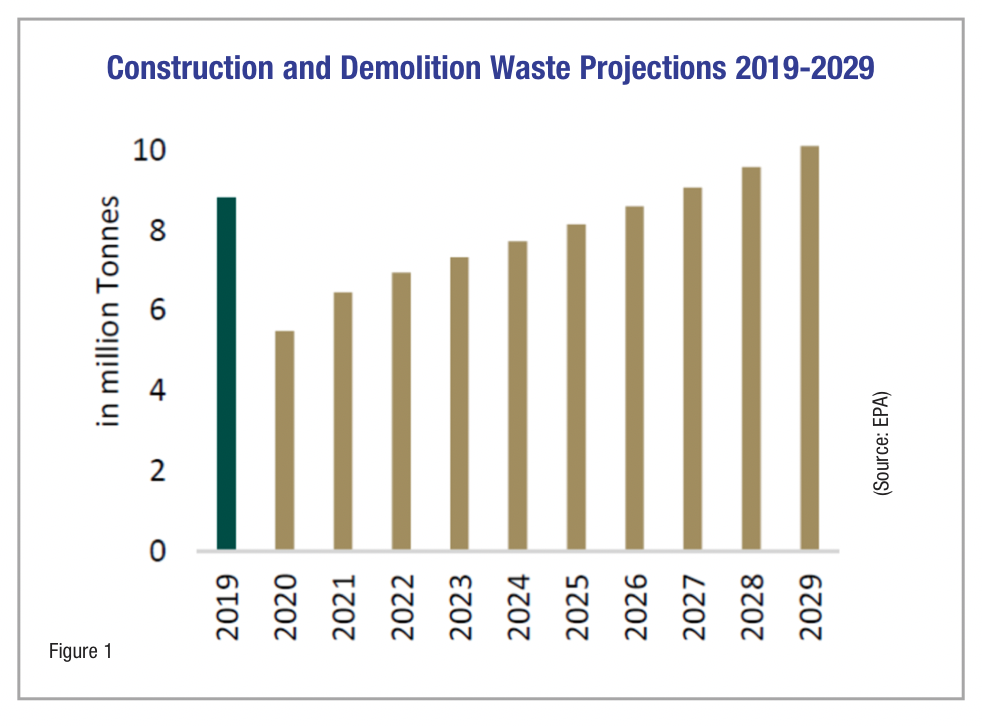

Figure 1 summarises national CDW projections to 2029, illustrating that the annual quantity of CDW generated in Ireland is projected to consistently increase over time. With the sector having experienced a remarkable resurgence since Covid-19, there is once again high demand for construction. The continual demand for development means action needs to be taken now to reduce the accompanying embodied carbon emissions from the built environment. Put simply, there is an upward trend forecasted for CDW from 2021 to 2029, and overall emissions are predicted to follow a downward trend, but embodied emissions are forecasted to increase. This is the space for policy intervention.

T: 087 119 4475

E: jkilroy@ciob.org

W: www.ciob.org