Pre-Budget 2026: Balancing resilience and risk

Budget 2026 is expected to deliver a package shaped by strong domestic growth but clouded by global uncertainty, with trade tensions, the housing crisis, and reliance on volatile corporation tax receipts dominating the fiscal landscape. In addition, with the cost-of-living remaining high, the Budget will not likely be winning this government any popularity contests.

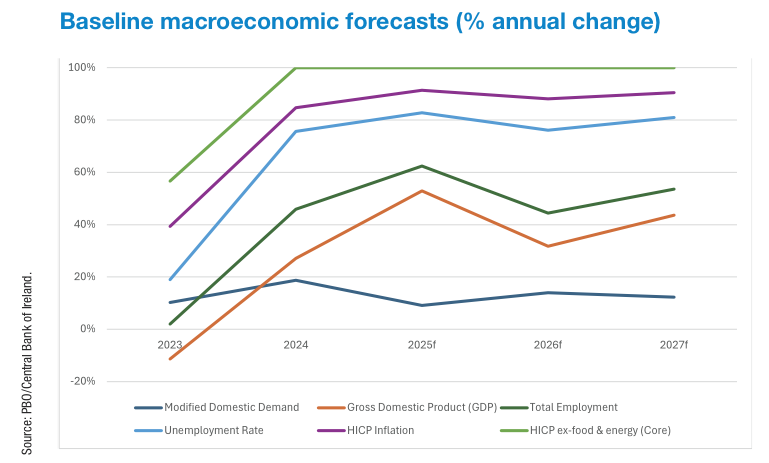

The State’s economy enters the 2026 budget cycle in relatively robust health. The Economic and Social Research Institute (ESRI) projects GDP growth of 4.6 per cent in 2025 and 2.9 per cent in 2026, with Modified Domestic Demand (MDD) rising by 2.3 per cent and 2.8 per cent over the same period. Employment remains high, with unemployment at close to 4 per cent.

Inflation is forecast to average 2.0 per cent in 2025 and 2.1 per cent in 2026, down from the highs of prior years. However, the ESRI warns that high energy costs and strong wage growth could mean that, while inflation remains low at a macro level, the cost-of-living remains high for most people in society.

While the domestic economy remains resilient, the broad fiscal outlook is tempered by external risks.

Global challenges

International conditions have become increasingly unpredictable. The global economic order was thrown into disarray in April 2025 after Donald Trump announced “retaliatory tariffs” on all foreign imports into the United States, with a 20 per cent baseline tariff for all imported EU goods escalating global trade tensions. Sector-specific levies have created fresh uncertainty for Irish exporters. While Ireland’s pharmaceutical sector has thus far been shielded, threats of broader trade restrictions remain.

Tánaiste Simon Harris TD has emphasised that Ireland’s budgetary planning must reinforce competitiveness and encourage market diversification. At the National Economic Dialogue in June 2025, Harris warned that tariffs are “economically damaging for all sides” and highlighted the need for investment in SMEs, research, and digital innovation.

On 27 July 2025, the European Commission and the American Government struck a trade deal, imposing 15 per cent tariffs on EU exports to the a US, drop from the 20 per cent proposal initially mooted by US President Donald Trump.

Prior to the final announcement on tariffs, Harris cautioned that foreign direct investment into Ireland is already slowing, potentially dampening productivity and growth. Budget 2026 is therefore expected to include measures that support export resilience and reduce dependency on a small number of markets.

Fiscal position and vulnerabilities

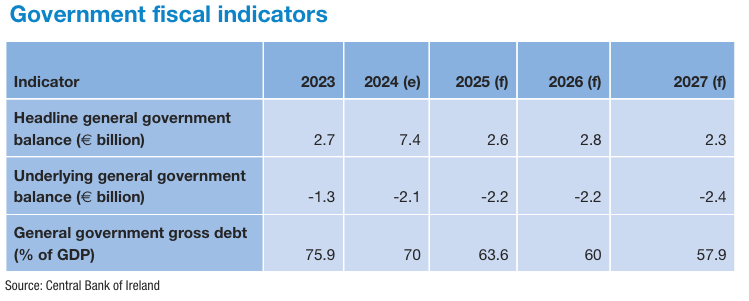

Headline public finance figures suggest strength, with healthy surpluses driven by exceptional corporate tax receipts. However, Minister for Finance Paschal Donohoe TD has warned that these receipts are volatile and cannot underpin permanent spending. In May 2025, Ireland’s corporation tax receipts stood at approximately €2.5 billion, representing a 30.2 per cent decline (about €1.1 billion less) compared with May 2024.

The Government’s fiscal approach is further constrained by the EU’s new medium-term budgetary rules, which fix net public expenditure over five years. Under this framework, Finance Minister has signalled that Budget 2026 must prioritise targeted investments particularly in housing, energy, water, and transport while avoiding overreliance on temporary revenues.

The Future Ireland Fund and the Infrastructure, Climate, and Nature Fund will play a key role in channelling windfall taxes into long-term projects rather than recurrent spending.

Housing and infrastructure

Housing remains the most pressing domestic challenge. Completions are forecast to increase from 33,000 in 2025 to 37,000 in 2026; however, this remains below estimated demand. Structural barriers such as high production costs, infrastructure bottlenecks, and labour shortages, continue to impede progress.

The Tánaiste has indicated that Budget 2026 will focus on accelerating housing supply. The allocation of capital spending will be critical, with the Government under significant pressure to demonstrate tangible progress in addressing the housing crisis.

Cost-of-living supports

Recent budgets have featured substantial cost-of-living packages, including energy credits and double child benefit payments, which have softened the impact of inflation on households.

Senior ministers have suggested there will be no one-off cost-of-living supports in the upcoming budget. Minister for Public Expenditure Jack Chambers TD warned in March 2025: “We want to move away from a position of one-off measures and ad hoc measures… and make sure that we have fiscal sustainability in the decisions that we make.”

However, despite falling inflation, the cost-of-living remains significantly higher than pre-Covid, with food inflation still outpacing broad inflation and prices not falling. This is further exacerbated by the persistent housing crisis and supply shortfall.

While the Government will be keen to shore up public finances early in its term, the likelihood is that there will be little by the way of support to help citizens with the cost-of-living. While financially sound, there will likely be significant public backlash against the Government amongst members of the public.

Income tax

The Summer Economic Statement 2025 indicates scope for a tax package of around €1.5 billion. However, a significant share of this could be consumed if the VAT rate on hospitality is cut to 9 per cent, as promised. Budget 2025’s €1.1 billion income tax package largely offset inflation without delivering real tax cuts, and similar measures are expected in the upcoming budget.

Indexing the tax system to 4 per cent wage inflation would alone cost €1 billion in 2026, leaving limited room for further spending reductions. Welfare and pensions are also under review, with the €12 weekly increase in Budget 2025 serving as a likely benchmark. The Government may also consider expanding targeted supports, such as a second child benefit payment for low-income families, though administrative complexity could be a barrier.

Carbon tax increases, potential adjustments to renter’s credits, mortgage relief, and excise duties are also expected to feature, with ministers balancing revenue needs against the cost pressures faced by households.

New fiscal framework

Budget 2026 will be the first shaped under the revised European fiscal framework, requiring the Government to commit to a defined expenditure path for the next five years. This new structure limits the scope for ad hoc spending increases and compels the Government to prioritise fiscal resilience amid upcoming trade and supply chain disruptions.

The Finance Minister has also stressed that the Government must use this budget to prepare for long-term challenges such as ageing demographics and the green transition. Strategic investments in renewable energy infrastructure, digital services, and productivity-enhancing reforms are expected to form part of the package.

Analysis

Ireland’s economic outlook is facing increasing uncertainty as the global order shifts away from open trade and investment toward protectionism and economic fragmentation. The Department of Finance’s discussion paper, Medium-term budgetary planning against a rapidly changing global backdrop, prepared for the National Economic Dialogue 2025, highlights the risks this poses to Ireland’s export-driven economy, particularly in light of the State’s reliance on multinational corporations and the outsized role they play in generating corporation tax revenue.

In the context of reconfiguring global supply chains and attempts by the US to regain manufacturing jobs which have been outsourced to other countries, the report warns that Ireland’s narrow tax base and dependence on a small number of firms could become significant fiscal vulnerabilities.

At the same time, the paper says that the Government’s medium-term budgetary framework must contend with looming demographic and infrastructural pressures, notably population ageing, the climate transition, and existing bottlenecks in areas such as housing, energy, and transport. The paper outlines how the resilience of the Irish economy will depend on boosting domestic productivity and maintaining competitiveness by addressing high costs and regulatory complexity. With domestic productivity still significantly lagging that of foreign-owned sectors, targeted investment in innovation, AI adoption, and R&D is seen as key to future-proofing the economy.

Looking ahead to Budget 2026, the focus of government will likely remain on safeguarding the sustainability of public finances by prioritising budget surpluses and continuing to diversify trade and investment links beyond traditional partners.

Taoiseach Micheál Martin TD says: “While we are in a strong position to address the needs of our country, we must remain conscious of the strong headwinds against us and the potential economic consequences we face due to decisions being made by others.”