Gas needed as transition fuel

Ireland’s lack of energy security is topical, and self-sufficiency is an area of particular weakness. While a government decision to end the issuing of new licences for gas exploration was clearly founded in the policy of transitioning to renewable energy, the reality is that gas is required as a transition fuel, writes William Holland, CEO of Europa Oil & Gas.

Currently, Ireland relies heavily on the UK for its gas supply and will do for the foreseeable future unless the government can create an environment where foreign direct investment (FDI) feels welcomed to invest in Ireland and fund the further development of its plentiful domestic gas resources. Although existing exploration licences are permitted to continue, the policy to end the issuing of new licences has sent the opposite signal from a country where FDI is a cornerstone of its economic development.

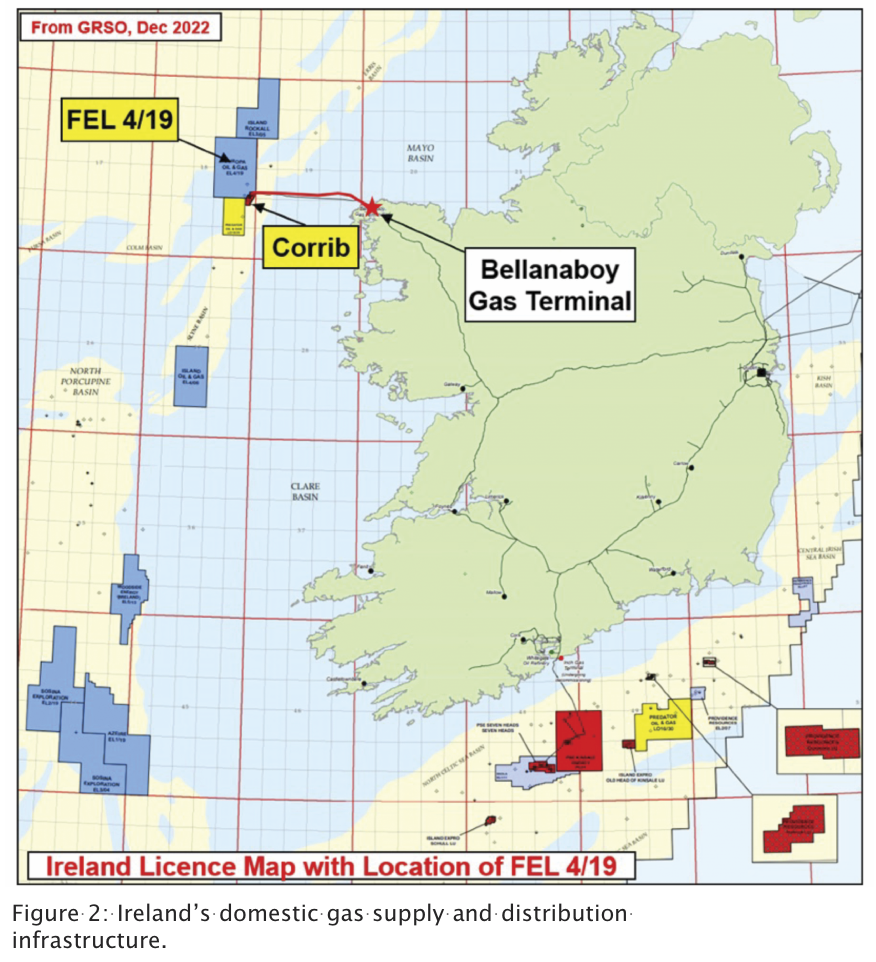

The sole source of domestic gas supply in Ireland comes from the Corrib field, located in the Atlantic Ocean roughly 85km offshore of County Mayo. Figure 2 shows the location of Corrib and the associated infrastructure that supplies Ireland with gas. Corrib supplies roughly 20 per cent of Ireland’s annual demand, with the remaining 80 per cent coming from the UK via the Moffat gas interconnector. The gas supplied from the UK comes from various sources including liquified natural gas (LNG), which has very high associated emissions intensity due to the cooling process to liquefy the gas before it is transported via sea tankers.

Adjacent to Corrib is the FEL 4/19 exploration licence, which contains two sizable gas prospects, and is owned and operated by Europa Oil and Gas. The first is about the same size as Corrib and the second is roughly twice the size of Corrib. Because these two prospects are geologically very similar to the Corrib gas field the risks associated with the development of these fields are well understood and the chance of success is high for an exploration project, roughly one in three for each of them. FEL 4/19 borders the Corrib field and as such the discovered gas within the FEL 4/19 licence could be quickly connected to the existing infrastructure and brought online to displace high emission imported gas from the UK/USA.

An independent emissions report by Sustainable, (www.esgable.com), calculated that the average emissions resulting from the development of domestic gas produced at FEL 4/19 would be 2.8kg CO2e/boe (kilograms of carbon dioxide equivalent per barrel of oil equivalent) compared to imported gas from UK which has an average emissions intensity of 36kg CO2e/boe, 13 times higher. The UK imports on average between 15 and 20 per cent of its gas supply from LNG, including LNG from the USA which, being fracked gas, which is gas extracted by hydraulically fracturing the shale/reservoir to release the trapped gas, has an emissions intensity 145kg CO2e/boe, 50 times more than the gas which could be produced from FEL 4/19.

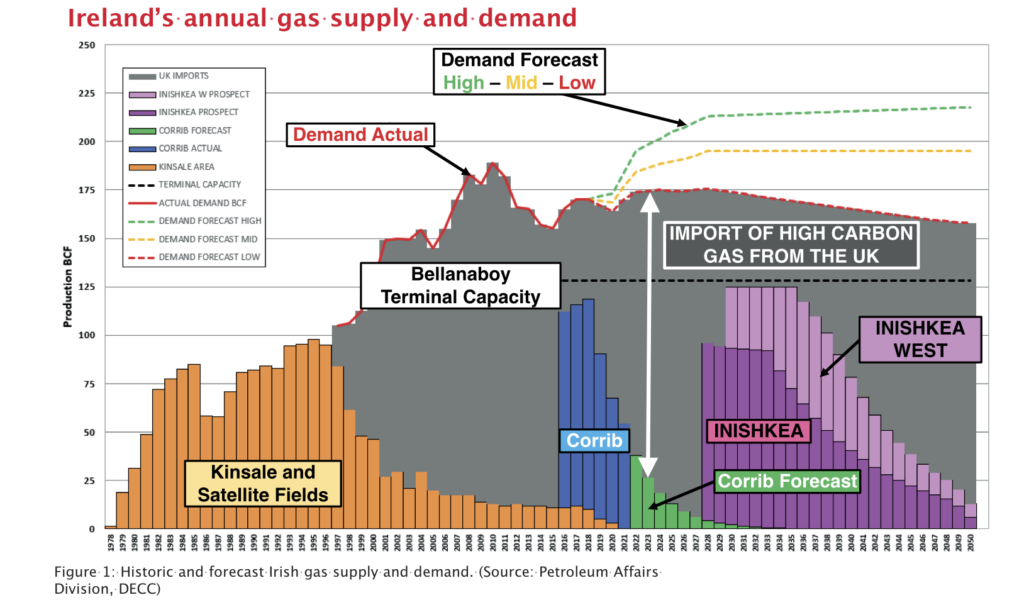

The Corrib field is in decline and without the development of an adjacent gas field it will produce less gas each year before eventually being shut down, potentially within the next 10 years. This will result in 180 well paid jobs being lost at the Bellanaboy Gas Terminal and will have a material economic impact on County Mayo. Any discovery at FEL 4/19 would extend the life of the Bellanaboy Gas Terminal and has the potential to provide Ireland with circa 75 per cent of its forecast gas demand until 2035. Figure 1 shows the historical supply and demand for gas in Ireland as well as the forecast demand until 2050. It is clear from this that natural gas will continue to play a major role in Ireland’s energy mix well into the future and, without new sources of domestic gas, Ireland will be completely reliant on high emission imported gas as soon as Corrib is shut down.

Exploration and development of an offshore gas field is a complex and costly business and to realise the potential of FEL 4/19 an international energy company would need to drill and connect these fields to the existing Corrib infrastructure. Although expensive, these activities would come at no cost to the Irish taxpayer. In fact, the development and production of domestic gas generates material income to the State through taxes and job creation. The development of FEL 4/19 is forecast to generate over €10 billion in taxes from just the licence itself, in addition to this there would be taxes from the jobs created at Bellanaboy and the associated economic activity that stems from this employment.

The risk-reward value proposition provided by FEL 4/19 to a major upstream energy company is not just highly compelling, it is world class. Yet since 2018 major energy companies, such as ENI, Total, Equinor and Woodside, have all exited Ireland. This is because Ireland is perceived to be an inhospitable jurisdiction by the upstream sector, a situation that was highlighted at the recent Energy Summit hosted by the Taoiseach. The fact is Ireland has the necessary legislation to explore and develop existing licences, such as FEL 4/19, but this is not recognised by the upstream industry as a whole. Perception is reality and in order to change the current perception of Ireland, the Government needs to vocally emphasise its commitment to the status quo, i.e., that the existing licences remain valid, any major upstream energy company that invested in Ireland would be welcomed, and that these exploration licences could be progressed through their natural phases of development and production. By doing so, the Government could secure a reliable and plentiful supply of domestic gas out to 2035 and beyond. Not only would this provide Ireland with security of gas supply but importantly the produced gas would be the lowest emissions gas that Ireland can obtain, which would reduce emissions and help Ireland achieve its net zero 2050 goals.

William Holland is CEO of Europa Oil & Gas (Holdings) plc, which owns 100 per cent of the FEL 4/19 licence.

E: mail@europaoil.com

W: www.europaoil.com