Electric mobility: Key trends

Capital markets, consumer demand, climate change reduction ambitions and new skills acquisition have created a momentum for electric mobility that even the global pandemic will not halt.

“The momentum behind cleaner, software-enabled forms of mobility is powerful and seemingly unstoppable,” a report by McKinsey and Company declared, before detailing four key trends driving clean, electric, connected mobility.

The assumption is a brave one when considering the levels of disruption future mobility ambitions have undergone in the past two years but an in-depth look at the trends serves to highlight that a slowdown in mobility demand driven by the pandemic should not have a lasting impact on the electric vehicle market.

Global EV sales in early 2019 had reached record highs, with an estimated two million EVs sold globally, but whereas previously statistics served to underpin predictions on EV growth, recent figures are obsolete because of the levels of unprecedented disruption. Global sales for 2020 were predicted to fall by between 20 to 25 per cent in a best-case scenario and up to 50 per cent in Covid-19 worst hit areas.

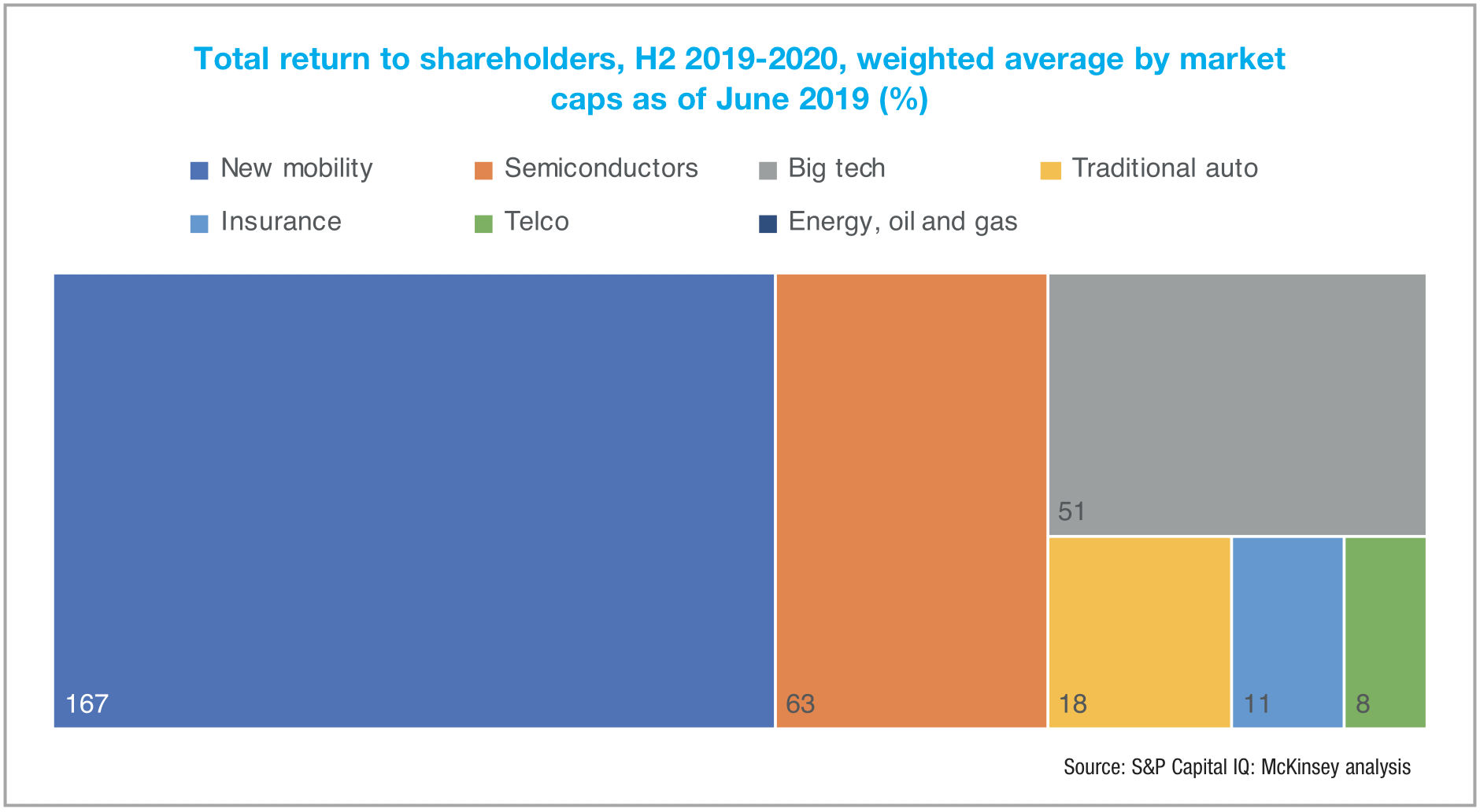

However, despite the disruption, significant momentum in a number of key areas points to resilience in the electric mobility market. The first of those key trends, as highlighted by McKinsey is the continued interest by capital markets. The report points out that under the disruption, the mobility industry continues to outperform top industries, including big tech, in capital markets.

Capital markets

The reasons underpinning performance are wide-ranging but the report points to key initiatives that appear to be driving capital market interest. The first is the opportunity for diversification. The direct replacement of internal-combustion engines by EVs is a massive market opportunity in itself, but recent years have seen the mobility industry initiate moves into more diverse markets such as shared mobility and the advanced connectivity solutions for EVs, offering clear pathways for market evolution in the decades ahead.

The second is the evolution and growth of the automotive software market, estimated to grow by 250 per cent by 2030 and the third is somewhat related to this software boom. New mobility players are approaching the future with a software-first mentality, attracting the best talent, compared to traditional industry players who will require a major shift in their operations and the reskilling of their existing talent.

A fourth reason is the appeal of green investment. Carbon neutral solutions are attracting the interest of investors and consumers. In response, the EV industry has sought to tailor its offering to consumer demands and customer-centric solutions have helped broaden the appeal beyond carbon neutrality.

Consumer demand

Governments across the globe have been grappling with the most efficient and cost-effective method of altering consumer behaviour. Most realise the importance of establishing a pathway for a major mobility shift out to 2030 if ambitions for 2050 are to be achieved. While in Europe, many member states are engaged in developing the roadmap to ensure a mass public EV transition, the McKinsey report highlights that other global nations are already well advanced in their journey. Offering a snapshot of what the global market may become, the report highlights that China’s automakers have adapted advanced technologies to meet and go above customer expectation. Beyond electrification, in vehicle technology customisation has seen a rapid spike in interest in vehicle connectivity, with consumers willing to spend more on connected vehicles.

Climate change

A further key trend identified by the McKinsey report is that of climate change and the perceived role of EVs in decarbonising transport. Road transport currently accounts for some 13 per cent of global carbon emissions and decarbonisation of the sector has been slow when compared to the likes of energy.

Of course, energy decarbonisation in the form of green electricity is an enabling foundation of EV rollout. However, experts suggest that time is running out for significant progress to be made in EV uptake if transport is to play its part in preventing the global temperature rise above 1.5oC in 2050. The scale of the challenge can be viewed in the context that a number of previously envisaged trigger points for mass EV uptake have already been triggered, for example, the cost of EV batteries has plummeted since 2010 to record lows and investment levels in EV-related tech have multiplied significantly. The report identifies five major challenges that remain:

- Pace: By 2035, more than 95 per cent of all cars and trucks on the road would need to be zero-emission to limit warming to the desired levels, making the next decade crucial.

- Leveraging the potential of transition technologies including hybrid vehicles and gas-powered cars.

- Exploration of multimodal mobility and traffic optimisation to reduce the miles travelled.

- Energy: the renewable share of power will need to be increased to reduce road transport emissions.

- Decarbonising supply chains: Ensuring that all aspects of EV delivery, including manufacturing and transport are decarbonised.

The significance of the challenge is great but one that has been accepted as necessary, and so, meeting climate change reduction ambitions is a driver of electric mobility and should drive cross-sectoral cooperation for a circular economy.

Skills

The final trend identified by McKinsey and Company is that of a recognition that skill sets will need to be adapted to meet mobility shifts. EV technology, software and connectivity will require very different skills sets to the existing combustion engine market and it has been recognised that mass uptake of EVs could result in up to a third of the current automotive industries workforce’s skill sets being insufficient. While new players in the mobility market have adopted an approach that sees them compete with big tech and other large industries for talent, the existing automotive industry is also attempting to diversify into the evolving market.

To do this, traditional players are recognising the need to develop, not only engineers of the future but skills in relation to software, data analytics and marketing. This skills development is driving innovation, helping to meet customer demand, and attracting investment into a market that, despite pandemic disruption, is gathering in momentum.