Scope for PPPs limited under Project Ireland 2040

Following the launch of Ireland’s largest ever public investment strategy, the National Development Plan, eolas analyses the suggestion that the appetite for PPPs is diminishing.

Following the launch of Ireland’s largest ever public investment strategy, the National Development Plan, eolas analyses the suggestion that the appetite for PPPs is diminishing.

The collapse of Britain’s second largest contractor Carillion, despite an annual turnover of over £5 billion, unsurprisingly shone a spotlight on the security of Public-Private Partnerships (PPPs).

While the impact of the Carillion collapse is limited to some school projects in Ireland, there are wider implications in the level of scrutiny afforded to PPP projects. Most of these concerns lie in the burdening of risk shouldered by the tax-payer if such a collapse does occur and therefore the need for greater transparency in the financial stability of all partners involved.

Advocates of PPPs have warned against allowing the Carillion collapse to overshadow the many benefits that PPPs can offer when developing infrastructure, highlighting that over €5 billion worth of infrastructure projects have been secured in this way in Ireland since the early 2000s.

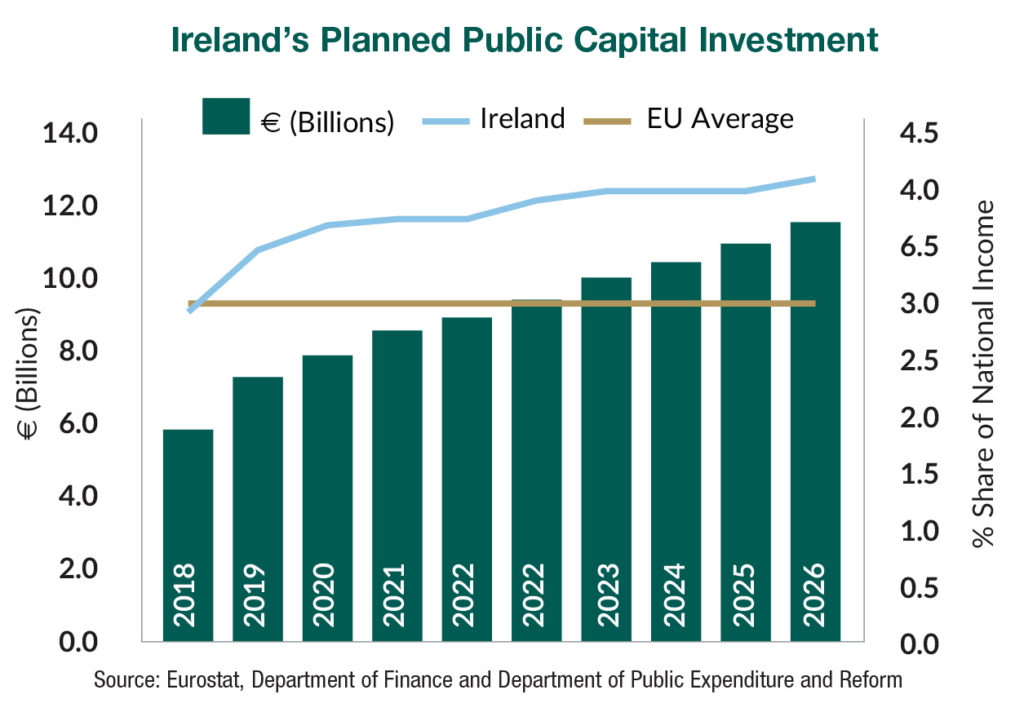

However, the new National Development Plan appears to signal a move away from PPPs as a favoured option of Government over the next decade. Summarising a recent Public Private Partnership (PPP) Review, established to examine the future role of PPPs against the backdrop of the Government’s plans for a substantial increase in Exchequer-funded public capital investment, the plan initially states that PPPs should remain a feature, broadly to the same extent as heretofore, in overall public capital investment.

Critics have pointed to a number of finer details which diverge from PPP advocacy. These include reference to the fact that PPPs “may not achieve value for money” given the planned increases in overall capital spending. Outlining the scope for alternative PPP-type contractual arrangements to be examined in 2018, the plan also highlights the need to consider “a less complex and shorter-term alternative PPP-type contractual arrangement, that could still offer some of the advantages of PPP but for smaller-scale projects, over a shorter time period”.

In the wake of Carillion, a move towards less complex and shorter-term alternatives for smaller-scale projects, would suggest the Government are wary that if a private sector partner and project is big, so too is the level of risk.

Potentially reversing the current spending limit of 10 per cent of annual Exchequer capital allocations back to the previous budgetary control mechanism used for PPPs, which required that the capital value of PPPs should be charged to the capital allocation of the sponsoring Department, means future PPP investment will be counted as capital spending in the early years.

The attractions of PPPs are numerous, including greater incentive for the private sector to curb building and running costs, however, its greatest attraction lies in the ability to keep borrowing off-balance sheet. Removal of this budgetary appeal would ultimately reduce the attraction of PPP investment for government.

While the plan does outline encouragement for projects which have the potential for user charges, such as toll roads, the encouragement is at odds with the recent government trend, which has seen them pay private operators when the road is available, as opposed to traffic-flow based revenue payments.

The most recent PPP projects outlined by the Department of Public Expenditure and Reform include the Schools Bundle, the M17/M18 Gort to Tuam road scheme, 450 new social housing units developed across eight sites in Ireland, the development of 14 Primary Care Centres under the European Fund for Strategic Investment (EFSI) initiative and new and refurbished courthouses within the Courts Bundle.

Project Ireland 2040, combining a 20-year plan for population growth of One million people (the National Planning Framework) and the €116 billion 10-year capital spending plan (the National Development Plan), has outlined ambitious infrastructure investment, for which private sector collaboration will be essential. However, the extent of the role PPPs will play over the next decade remains to be seen. In the UK, the equivalent to PPPs (PFIs) has come under scrutiny following a report by the National Audit Office (NAO) which concluded that reliance on private finance is more expensive that funding projects directly with tax-payers’ money. The UK has over 700 PFI contracts currently, estimated to be worth over €80 billion.

Summary: The future role of PPPs

A summary of findings of the review established to examine the future role of PPPs against the backdrop of the Government’s plans for a substantial increase in Exchequer-funded public capital investment.

• PPPs have made a very significant contribution to the delivery of priority public capital infrastructure in Ireland.

• In light of the role that PPPs have played in recent decades in delivering public capital infrastructure with private funding and full transparency on the economic cost of projects, PPPs should remain a feature, broadly to the same extent as heretofore, in overall public capital investment.

• In the context of the Government’s plans to increase public capital investment to amongst the highest levels in the EU in GNI terms, the pursuit of further additional investment projects by PPP over and above this planned level of public capital investment would pose a risk that such projects may not achieve value-for-money and/or could give rise to a level of public capital investment overall that is not consistent with macroeconomic or fiscal sustainability.

• It is essential that projects are judged on their merits and if PPPs offer better value-for-money than traditional procurement, they should be selected on that basis. It is recommended that the current limit of 10 per cent on the exposure of annual Exchequer allocations be replaced. The previous budgetary control mechanism used for PPPs which required that the capital value of PPPs should be charged to the capital allocation of the sponsoring Department will be re-instated.

• There is evidence that, where Exchequer resources are available to fund priority public capital projects, there can be a reluctance to examine the potential for PPP procurement. This may reflect the often high degree of complexity involved in PPP procurement. In these circumstances, it is important that PPPs should continue to be considered as a procurement option for appropriate public capital investment projects, within the suite of capital investment mechanisms available to Departments and should be assessed on a level-playing field basis as compared to traditional procurement.

• Projects which have the potential for user charges or which offer the potential to generate significant third party income should, in particular, be considered in terms of their suitability for procurement as PPPs, based on a concession model.

• As an incentive to the use of PPP, where a project offers the potential for user charges (i.e. concession projects), the self-financing element of any such concession PPPs may be discounted when charging the project to the sponsoring agency’s Exchequer capital allocation. This should encourage the use of PPP for the delivery of such projects.

• In addition, in recognition of the challenges that PPPs can pose for Departments in terms of the complexity of the contract and the long term nature of the financial commitments involved, the scope for a new procurement option will be examined in 2018 comprising a less complex and shorter-term alternative PPP-type contractual arrangement, that could still offer some of the advantages of PPP but for smaller-scale projects, over a shorter time period.

• Finally, in order to improve transparency in reporting on PPPs, a number of changes in the reporting arrangements for PPPs are also recommended.