Processing payments in the digital age

This article looks at the digital architecture behind payments for public services and considers how payment solutions will look in the next phase of the digital revolution.

Technology has radically transformed the way that we manage our daily lives. Skype and Facebook have made very obvious changes in our social lives, but the development of digital services has also changed our lives in less obvious ways. In particular our public services are experiencing a quiet digital revolution which is changing the way that public services operate and how they interact with the public. One area where this change is particularly evident is in payments where all parts of the ‘payment chain’ have been impacted. Irrespective of whether payments are moving between the person and a public body (i.e. paying water charges) or between a government organisation and its suppliers, payments are now being managed using digital solutions.

However it is not possible to deliver digital payment solutions without the right digital architecture in place.

Digital services architecture

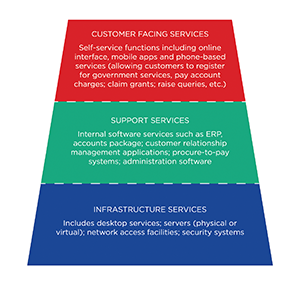

When looking at digital services in an organisation it is helpful to visualise a tiered architecture with customer-facing services at the top, support services in the middle, and essential applications and infrastructure at the bottom tier.

In the context of public services and local government, the digital architecture would incorporate customer-facing tools that allow end users to access the services they need. Beneath those customer-facing services public bodies use appropriate software applications and hardware infrastructure to ensure that the services will function efficiently and securely.

When designing their digital strategy organisations now focus on combining in-house expertise with the right partnerships, the right architecture and the right resources. This approach enables public bodies to serve their customers using a mixture of external and internal resources. Whereas in the past organisations needed in-house expertise to support their internal ICT solutions, now the digital services model allows organisations to use external expertise through cloud-based solutions and outsourced services. This leaves the organisation free to focus on core activities such as service delivery and innovation.

Payment solutions in the digital architecture

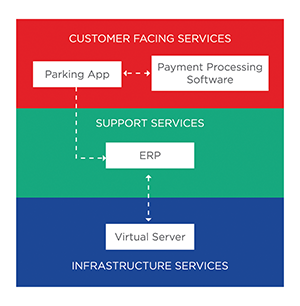

An efficient digital architecture uses a variety of modules in order to meet the organisation’s needs. For example a digital approach to paid parking could involve combining a parking app with payment processing software; this software registers the payment with the parking authority’s enterprise resource planning software (ERP). The ERP software may in turn be hosted in the Cloud: this cloud-based hosting forms part of the infrastructure tier of the system architecture.

The benefits of using this kind of tiered, modular approach include:

Flexibility a modular structure makes it easier to add or remove services in each tier, so that service changes can be made more quickly

Reliability it is easier to switch between providers and move to back up systems for disaster recovery

Expertise businesses can apply the appropriate specialist expertise within the various tiers

Security any potential risks are contained within specific modules rather than being spread across the whole IT system. A modular architecture also makes it easier to diagnose and mitigate any IT security risks at the outset

Enablement The above factors enable better customer service, greater efficiency and lead to cost reductions in the organisation

Impact of the digital services model on payments

The digital revolution has given us new consumer payment tools such as Paypal, Visa contactless and ApplePay. Significant innovations are also taking place in middle-office payment architecture, with the growth of new approaches to accounts functions and a range of new digital solutions available to facilitate procure-to-pay and ERP integration. These services are provided by a new breed of digital payments businesses that tend to focus on solving one particular problem really well. For example Paypal has used its expertise in online payment wallets to become a global force in financial services.

While the digital revolution has benefited finance specialists, it has also impacted large institutions which were regarded as ‘one-stop shops’ for financial services in the past. For instance, banks used to be the source for all financial services (payments, account services, secured lending and personal credit). Now non-bank financial firms are disrupting the ‘one-stop-shop’ model by offering more efficient services through digital channels. In response to this challenge the banks themselves are moving away from their role as omnibus financial service providers and seeking to become specialists in specific areas.

Government bodies have not been slow to adapt to this change: where ten years ago most public sector bodies would have sourced all of their banking and payment services from a single bank, they now procure these services from a range of financial service providers using a modular approach.

Financial services in the digital architecture

In order to succeed in the digital age, financial service providers need to offer the right combination of expertise, flexibility, security and reliability. They need to have a proven understanding of their field and a demonstrated ability to connect with all of the other elements of an organisation’s systems architecture. Most importantly they need to provide digital payment solutions that enable better service delivery, better access to data and improved customer engagement.

In the future organisations will find themselves using multiple payment services within their digital systems architecture. A number of different providers will deliver payments solutions such as card payment processing, procure-to-pay, funds transfers, accounts receivable and refund processing. By combining the right architecture, the right tools and the right partners, the government sector will enjoy the benefits of the digital revolution and unlock even more value from its payment functions.

Digital architecture behind a parking app

About FEXCO CFX:

FEXCO CFX is a payment solutions specialist that designs and delivers tailor-made payment solutions for commercial and government sector clients. FEXCO Corporate Payments trading as FEXCO Commercial FX Services is regulated by the Central Bank of Ireland.

Ruth McCarthy

CEO FEXCO Commercial FX Services

Killorglin, Co. Kerry

Tel: +353 66 976 1258