Outlook for the PPP market in Ireland

After a decade of under investment in infrastructure as a result of the financial crisis, Ireland’s improved credit rating and a lack of investment opportunities across Europe means that the country’s position is favourable to private investors. Gerard Cahillane looks at the future outlook for the PPP market in Ireland.

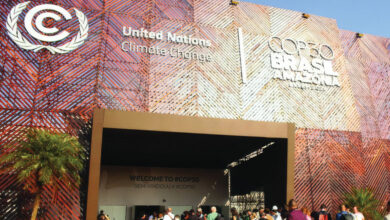

Speaking at a recent conference in Belfast on infrastructure investment, Deputy Director of the National Treasury Management Agency and Head of Finance and Operations for the National Development Finance Agency, Gerard Cahillane, said that an additional €5 billion announced by the Minister for Public Expenditure and Reform for capital expenditure by 2021 represents an acknowledgement of the need to invest in Ireland’s infrastructure.

Infrastructure investment in Europe has all but collapsed since the economic downturn. Recent statistics show that between 2008 to 2015 accumulative investment in business, households and public sectors have declined by £261 billion annually. Government investment in capital projects has been reduced by £34 billion across Europe and the decline of corporate investment by £109 billion across Europe for the same time frame would suggest that there are corporations such as insurance companies and pension funds with a wall of money but struggling to find good projects.

The global slowdown of investment is evident in Ireland through analysis of the Net Capital Stock. Prior to the downturn, the period 1995 to 2004 showed fairly strong investment but currently investment is just about offsetting the levels of depreciation. Cahillane said: “The economy in the Republic of Ireland in 2014 grew by 5.2 per cent, last year it grew by 7.8 per cent and forecasts for 2016 are between 4.5 to 5 per cent. The population in 2014 grew by 35,000 people, last year by 20,000 and the forecast is that that will continue over the next number of years. It means that we have one of the fastest growing economies in Europe with a growing population but the level of capital stock is not keeping in line. In the last 10 years the remaining life in public sector assets have been declining. There may be a lot of investment going into care and maintenance but there is very little in additional stock. We have an ageing stock now which needs to be replaced and added to.”

In 2012 the Irish government introduced phase one of a private-public partnerships (PPPs) Stimulus Package and identified a number of projects that could use off balance sheet private investment to complement the existing public capital programme. These projects included schools, court houses, primary care sectors and roads.

Cahillane said that moving forward in 2014 the government recognised a huge shortage for social housing and plan to test the PPP model for delivery, with the NDFA providing financial advice and acting as the procuring authority. In November the government identified a further €500 million worth of projects in the sectors of health, justice and third level education.

“In 2010 we had a number of projects that we couldn’t close because nobody would lend privately to PPPs in Ireland at that time. In 2012 we closed two deals, however, there were no foreign banks involved and only one Irish bank and the European Investment bank (EIB). The EIB would only co-invest with the Irish bank provided that the National Pensions Reserve Fund would underwrite the domestic bank investment during the construction period. That will tell you how difficult it was.

“However, by the time we ran another funding competition in 2013 we noticed an increase in interest. Our credit rating had moved out of sub-investment grade as we moved out of the Troika programme. In 2014 there were around 20 genuine private funders and last year that figure was between 40 to 50. When we were closing the deals back in 2012 the cost of the senior debt was around the 6 per cent mark but over the last number of years it has fallen significantly to a historically low level.”

A lack of investment opportunities abroad and Ireland’s improved credit rating has made it appealing to the private sector and where banks were once the main investor in capital infrastructure projects, there are now as many institutions invested in projects as there are banks.

Summarising, Cahillane said that while a huge investment gap still existed in Ireland in a time when government was under severe fiscal restraints, historically low funding costs and international investment interest in Ireland should be acted upon so long as they fall within the value for money framework. “In my view PPPs present a good opportunity to fund long-term infrastructure competitively to facilitate social and economic development.”