New Marshall Plan needed

ICTU’s Macdara Doyle calls for a new approach to fight stagnation and extremism in Europe.

ICTU’s Macdara Doyle calls for a new approach to fight stagnation and extremism in Europe.

Toxic economics breed toxic politics, as sure as bust follows boom. For the past five years, there has been a steady flow of toxic economics emanating from key institutions of the European Union, primarily the European Commission and the European Central Bank.

Their nonsensical insistence that the same dogma which caused the crash could also provide the solution to the crisis has met with predictable results.

Now the spectre of deflation haunts the euro zone and even the head of the IMF, Christine Lagarde, has taken to warning that “without a change in policy the world faces years of slow and subpar growth.”

And across the euro zone, toxic politics have seeped into the mainstream, with the success of the National Front in France just the latest in a long line of examples.

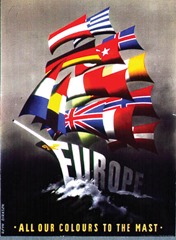

Europe has been down this road before, with disastrous consequences. Indeed a driving force behind the very foundation of the European Union was to ensure there could be no return to those dark ages.

And a key premise for achieving this goal was that the EU would act to drive up living standards and working conditions across the continent: that decent work and good social systems would be the bedrock on which the union would rest.

Yet the last five years have seen a co-ordinated and wholly man-made erosion of living standards and dismantling of social protections across the EU. The alleged rationale is that Social Europe made the region uncompetitive and, depending on what member state you are in, was either a barrier to recovery or a cause of the crash in the first place.

That is demonstrable nonsense, but it is nonsense that enjoys strong support at senior levels in EU member states, including Ireland. And that has consequences.

Is it any wonder, as people see social protections vandalised and living standards fall – to protect the ‘integrity’ of financial speculation – that the resulting insecurity and anger would make them more receptive to the seductive simplicity of xenophobes?

More than 26 million people out of work across Europe is political failure writ large, a failure which is likely to have serious consequences in the coming European elections.

As the ECB ponders what technical measures it might deploy to combat looming deflation, it seems that the institution – along with the Commission – would be better to focus on why we are on that slippery slope to begin with and how we might reverse course and rebuild Europe.

As the work of French economist Thomas Piketty – ‘Capital in the Twenty First Century’ – demonstrates, growing inequality imperils the very future of the society we live in, as we risk recreating the social divisions of 19th century Europe along with similar social tensions.

Germany’s largest trade union federation – the DGB – has produced a new initiative that aims to reverse the ruinous policies of recent years. With a clear eye on history, they have entitled it: ‘A Marshall Plan for Europe’.

The incoming head of the DGB, Reiner Hoffmann, outlined the workings of this plan during a conference hosted by Congress in Dublin recently.

In short, the plan is a massive, multi-annual multi-billion co-ordinated programme of investment that aims to reflate the entire region – just as the original post war initiative did.

The plan prioritises investment in energy production, communications infrastructure and new skills. It would be financed by taxes on wealth and speculative activity, such as the financial transaction tax.

The plan has been endorsed and effectively adopted by the wider European trade union movement, precisely because it is working people and those in receipt of welfare who have borne the brunt of this crisis thus far.

If that or some similar initiative is not adopted soon, we will continue down the slippery slope and toxic politics will inevitably engulf the mainstream.