Deal and no deal scenarios

The level of real output in the Irish economy will be significantly lowered as a result of Brexit, even if a deal is agreed, a study by the Economic and Social Research Institute (ESRI) has found.

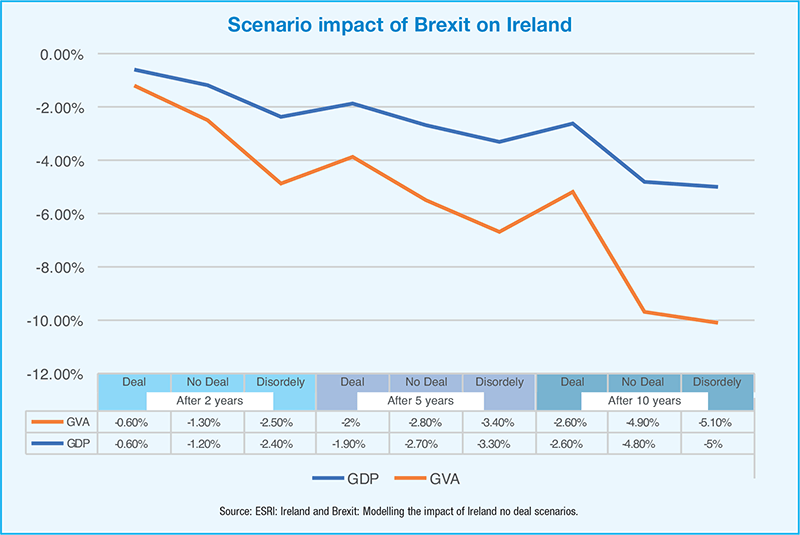

Assessing the three over-arching potential outcomes from the current negotiations between the UK and the EU of deal, no deal and a disorderly no deal, the report has found that in 10 years’ time the level of real output in the Irish economy will be at least 2.6 per cent lower, in the event that a deal is reached. However, estimations are for a greater fall to 4.8 per cent in the event of a managed no deal scenario and further to 5 per cent in disorderly no deal scenarios.

“The magnitude of each of these shocks is considerable and will have negative effects throughout the economy on the household sector, the labour market, firms and the public finances,” the report states.

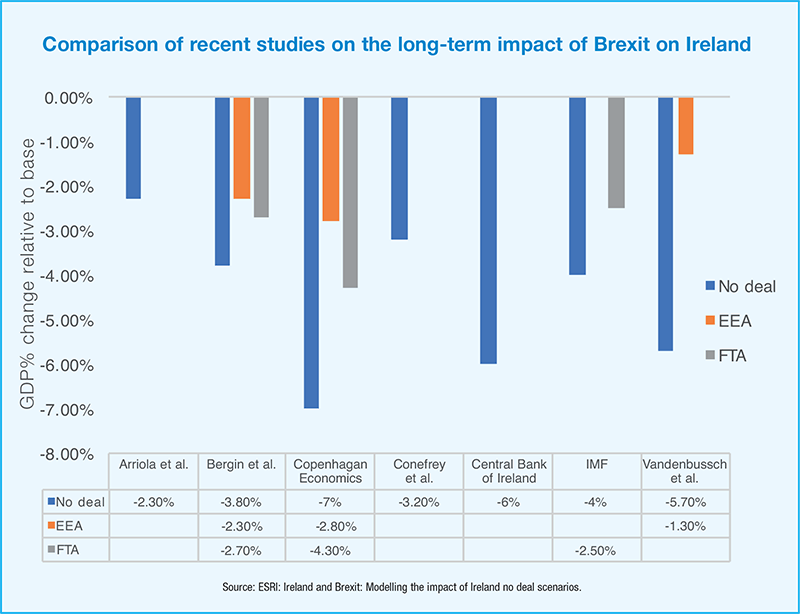

Based on the understanding of Ireland’s close economic relationship with the UK, the ESRI study points to the range of existing evidence that indicates that Ireland will be hit relatively hard by Brexit compared to other EU countries. The analysis focusses on the well understood channels through which Brexit will affect Ireland, such as lower trade, the impact of tariff and non-tariff measures and the potentially positive impact of FDI diversion to Ireland.

The three scenarios considered are detailed as:

Deal: An orderly exit from the EU involving a transition period covering 2019 and 2020 and a free trade deal thereafter.

No deal: An exit with an orderly period of adjustment where ultimately WTOP tariff arrangements apply to goods trade, with some non-tariff measures and negative impact on the services trade.

Disorderly no deal: Incorporating an additional disruption to trade in the short-run, as well as the factors considered in the no deal scenario but some negative trade impact is offset by FDI being diverted to Ireland.

While there is uncertainty around when trade and FDI impacts will be recognisable in the UK and Ireland, arguably a greater level of uncertainty exists in the short-term impact of Brexit, depending on the shape of any transition to new trading arrangements.

Assessing this short-term impact, the ESRI scenarios indicate that by 2020 the level of real output in the Irish economy would be 0.6 per cent (deal), 1.2 per cent (no deal) or 2.4 per cent (disorderly no deal), compared to a situation where the UK continues to remain in the EU.

In each of the scenarios the level of Irish output is permanently below where it otherwise would have been were the UK to have decided to remain in the EU. Although it is worth noting that the negative impact on Irish output in the long run in a deal scenario is approximately half that of a no deal scenario.

The two main channels through which the Brexit shock will impact on the Irish economy are those of negative trade, serving to reduce economic activity below where it otherwise would have been and positive FDI, serving to offset the overall negative impact. While it is recognised that the imposition of tariff and non-tariff measures will lower international market activity and reduce demand for Irish exports, the report makes the assumption that additional FDI would boost activity and labour productivity in the traded sector, having a positive impact on wages and employment. However, in each of the scenarios, the magnitude and timing of the shocks differ and are smallest in the deal scenario.

“In the no deal scenario global demand for Irish exports falls by 4.2 per cent compared to the baseline by the end of 2019 and by 7.6 per cent by the end of 2028. Overall, the shock leads to output in the traded sector and exports remaining below baseline values over the medium to long-term. In the long run, output in the traded sector is 3.1 per cent (deal), 5.9 per cent (no deal) and 6.1 per cent (disorderly no deal) below baseline.

Discussing the likely impact of Brexit on the Irish economy, the study points to a rise in consumer prices of 0.5 per cent (deal) and 0.9 per cent (no deal and disorderly no deal) due to higher import prices. A loss of competitiveness would create a downward pressure on wages and in each scenario, there is a negative impact on real wages.

A fall in traded sector output also results in lower labour demand, which will impact the employment and unemployment rate. In the long-term outlook the unemployment rate is 1 percentage point higher in a deal scenario and 2 points higher in the two no deal scenarios.

Loosening of the labour market will lead to lower average wages and this in turn will impact negatively on the participation rate and overall labour supply. This combination of lower wages and lower employment will reduce real personal disposable income and reduce consumption and imports.

“With both output and employment below base in all three scenarios, government revenue from taxes will remain below base and increase in the unemployment rate would lead to higher government spending on welfare payments. The net effect is a reduction in the general government balance (GGB).”

A context to the differing GDP scenarios offered by the study is that the Irish economy will continue to grow in each scenario but with a growth rate lower than if Brexit did not occur.

“If we assume the Irish economy would grow by 3 per cent per annum over the long run if the UK stayed in the EU, the impact of Brexit is roughly equivalent to a 0.3 percentage point reduction in the long-term growth rate in a deal scenario and around 0.6 percentage points off the long-term growth rate in the no deal and disorderly no deal scenarios.

The report concludes: “There are both upside and downside risks to these estimates. On the upside, to the extent that businesses have been preparing for Brexit and finding ways of reducing trade exposures, this will help offset some of the negative impact. On the downside, the impact of Brexit could be more severe, especially in the short run, if there is a continued period of uncertainty which could impact investment decisions or if there are even larger disruptions to trade.”