Construction growth continues

Increases in both residential building and civil engineering activity, offset by a slight decrease in non-residential building, has seen Irish construction continue its growth in 2019, with employment figures rising in tandem. However, the figures are still some way off the required levels needed to answer the housing crisis.

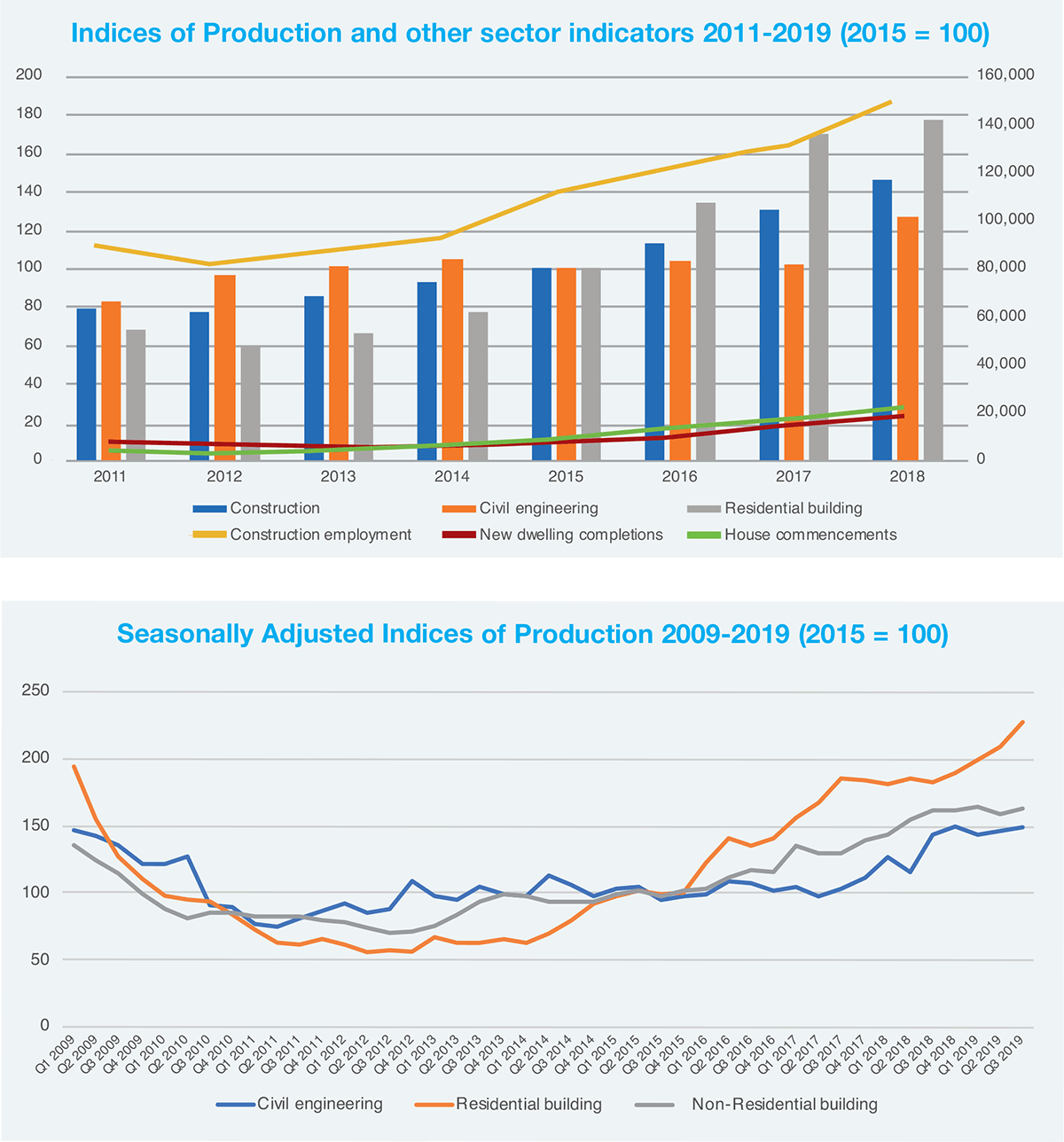

Provisional construction figures for quarter three of 2019 and final figures for quarter two show increases for the overall volume and value indexes for Q3 2019, 55.8 per cent and 67.4 per cent higher than their 2015 levels respectively, with quarterly rises of 2.5 per cent and 2.8 per cent. Both also represent rises year-on-year, with volume having risen 3.1 per cent and value up by 4.6 per cent since Q3 2018. The production index score of 167.4 is the highest score since Q4 2008 (175.5), although it is still some way away from the heights of the property bubble, when scores as high as 320.2 were recorded in Q1 2006.

The largest increase has been in residential building, with an 8.2 per cent quarterly increase in the seasonally adjusted volume index and a 22.8 per cent yearly increase. Civil engineering activity also rose by 1.7 per cent quarterly when seasonally adjusted and yearly by 3.1 per cent. Non-residential construction, while showing a 2.2 per cent quarterly increase on the seasonally adjusted index, did suffer a 0.5 per cent decrease on a year-on-year basis.

When tied in with national employment figures for the construction sector, the figures released by the Central Statistics Office show employment rising in tandem with the volume of production. With the volume of production rising by 12.1 per cent from 2017 to 2018, employment numbers, as measured by the Labour Force Survey, also rose by 13.8 per cent in the same period. Residential building rose by 4 per cent also within that timeframe, with new dwelling completions up by 25.4 per cent. The overall figure for dwelling completions, 18,072 in 2018, was the highest total recorded since the statistic began to be collated in 2011.

Commencements of new builds were up 27.9 per cent and their highest overall number, 22,467, since 2008, although they were some way off 2006’s level of 75,602.

2019’s measurement of construction output has more than doubled in terms of value since 2013, where output was valued at €9.723 billion and 6.1 per cent of Gross National Product. In comparison, construction for 2019 was estimated to be at €23 billion and 8.7 per cent of GNP.

The granting of planning permissions for dwellings also rose in Q3 of 2019, the most notable figure within the planning permission figures being an 80 per cent rise in the granting of permission for apartments following the overhaul to planning guidelines in March 2018 that made it cheaper for developers to build apartments. This will be received as good news in the construction industry as it points to sustained growth for the construction sector in the residential sector at the least.

Q3 2019 saw 10,590 planning applications for homes approved. 5,656 of these were apartments, with 4,954 houses. Permissions granted showed an overall yearly increase of 32 per cent in applications granted; 80 per cent in apartments and 1.1 per cent in houses. The disparate levels of apartment and house growth could perhaps be explained by Ireland’s status as an EU outlier in terms of apartments making up a section of housing. With a 55 per cent rise in apartment completions in 2019, Ireland’s share of apartments as housing rose to 17 per cent, way behind the EU average of 59 per cent.

The overall figure for Q3 planning permissions granted was more than the yearlong figures for the years 2013, 2014 and 2015, further signifying the rate at which construction of housing has skyrocketed in the midst of the housing crisis. The figures also continue the recovery of a small dip in Q4 2018 and Q1 2019, where numbers dropped by 4 per cent in both quarters. The overall has now surpassed the level before the dip, the 8,018 recorded in Q3 2018.

Planning permission for one-off houses (1,514) was in line with the 1,100-1,600 bracket that has been constant since Q3 2016, but still not near the level of over 2,000 permissions per quarter of 2009.

Homebuilding overall increased by 19 per cent in 2019, with 21,5000 homes completed according to an estimate by Goodbody. The estimate was arrived by examining the issuing of new energy ratings issued to homes upon completion. Ireland is now at almost five times the rate of the low of 2013, when 4,575 homes were completed, but still a long way behind the 34,000 figure the Central Bank has stated is needed per year.

Goodbody has predicted that the number of houses delivered in 2020 will be 24,000, driven by further apartment growth and the building of social housing, still some 10,000 short of the Central Bank’s need estimate.