‘A more normal year’

Having “successfully overcome” a series of successive shocks through Covid-19, the energy crisis, and the cost-of-living crisis with “surprisingly little damage”, the Irish labour market and economy are stronger in many respects than before the pandemic, new NERI research suggests.

Overview

Despite emerging from such shocks relatively unscathed, the report by Nevin Economic Research Institute (NERI) co-director Tom McDonnell states that the “post-pandemic bounce in the Republic of Ireland’s economy has ended”.

Retrenchment in sectors dominated by foreign direct investment such as ICT and pharmaceuticals has seen the end of sector-specific “booms” in investment and exports, while cost of living pressures have “eroded” consumer confidence and resulted in demand constraint.

Export potential in 2024 will be ‘dampened’ by a “relatively weak external environment” and the unwinding of the savings rate is predicted to restrict the potential for household potential to rise. Coupled with these predictions is that of high interest rates creating a “drag” on investment and concerns about higher than usual levels of business failure, although NERI states that these pressures will “hopefully recede over the course of the year [2024] as monetary policy loosens”. McDonnell also claims that these high interest rates will impact housing supply and the ability to address capacity constraints in infrastructure.

Despite these pressures, NERI still predicts that the Irish economy will grow in 2024, but that the pace of growth will moderate towards a “more ‘normal’ pace compared to the volatile 2020 to 2023 period”. With price inflation set to continue to fall throughout 2024, consumer and business confidence are expected to be boosted, with modified domestic demand predicted to grow by 2 per cent, and this increased demand to lead to a gradual loosening of the European Central Bank’s monetary policy.

Budget 2024

Despite its “evident flaws”, NERI states Budget 2024 will go down as “one of the most consequential budgets of recent years” that will add to growth and inflation in 2024 due to its “modest stimulatory and pro-cyclical” measures. NERI states that these measures are “hardly ideal” with the economy close to or at full employment and run counter to monetary policy.

The report criticises cost of living supports within the budget as “generally untargeted with significant deadweight in terms of averting poverty” and states that once-off supports “make little sense given the permanent nature of the price increases”. The Fiscal Council estimates that tax cuts in Budget 2024 will raise consumer prices by between 0.8 per cent and 1.5 per cent. These tax cuts and their “regressive nature” are said by NERI to have been “expected but still unwelcome”, with the main beneficiaries being those earning over €71,000 per annum.

NERI states that the most consequential measures in the budget will be the creation of two funds – the Future Island Fund (FIF) and the Climate and Nature Fund (ICNF). The FIF will “eventually produce a new revenue source from the middle of the next decade and reduce the fiscal pressures caused by an ageing population”, with the ICNF said to possibly “end up insulating the capital budget from the economic cycle”.

Overall, public finances are said to be performing well, “assisted by the healthy state of the labour market and the ongoing profit shifting into Ireland”, with “very substantial surpluses” projected for the next few years. The medium-to-long-term fiscal position is, however, said to be “much more challenging” due to age-related pressures, the cost of climate action, and diminishing revenues from green taxes.

Labour market

The labour market is “still performing robustly, albeit with some evidence that the boom in employment is slowing down”, NERI says, with the number of people employed having increased by 4 per cent in Q3 2023 year-on-year. The labour participation rate is at its highest rate since 2008 and increased by 1 per cent on an annual basis to 65.8 per cent, with regional participation rates ranging from 62.4 per cent in the mid-west to 67.7 per cent in Dublin.

Hours worked in the economy reached a third-quarter record of 82 million hours per week in 2023, up 2.1 per cent from Q3 2022, but NERI states that there is “tentative evidence that the labour market boom is ending”, with the job vacancy rate falling to 1.2 per cent in Q3 2023 and the employee index registering no net growth in employment between August and September 2023. The seasonally adjusted unemployment rate was recorded at 4.8 per cent in November 2023, increased from 4.1 per cent in March 2023. Male unemployment rose from 4.3 per cent to 4.9 per cent in the same period, while youth unemployment rose from 10.2 per cent to 12.4 per cent in November 2023. Despite these concerning increases, the labour market remains “very tight” and its previous growth said to be “unsustainable”, with the Q3 2023 long-term unemployment rate of 1.1 per cent representing a record low. NERI predicts employment to grow by 1.5 per cent in 2024.

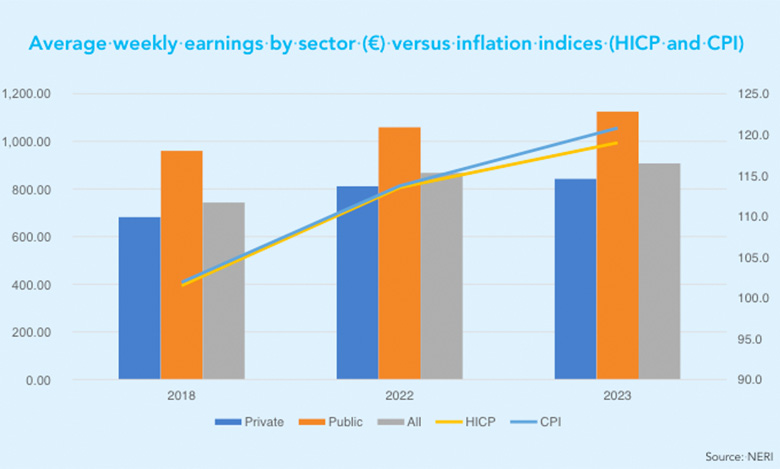

Wage growth was flat between Q2 and Q3 2023; despite this, Q3 2023 recorded a 6 per cent increase in wage growth year-on-year in nominal terms. Average weekly earnings increased by 4.6 per cent annually (3.9 per cent in the private sector), while average hourly earnings were up 6.2 per cent. Consumer price index increases averaging 6.2 per cent in Q3 2023 mean that weekly earnings fell in real terms, with average hourly earnings growth flat. NERI predicts a real terms growth in wages in 2024, with the consumer price index predicted to grow by 3 per cent and nominal wage growth predicted to be 4.5 per cent.