EU clear loser in lopsided trade ‘deal’

After months of uncertainty, the EU and US have agreed a trade deal creating a tariff “ceiling” of 15 per cent, but with Donald Trump already threatening a further 250 per cent tariff on pharmaceuticals, and the EU pledging €1.3 billion of extra investment in the US, the deal fails to re-establish order in the ‘transatlantic alliance’ and risks further fracturing the European body politic, writes Clayton Taylor.

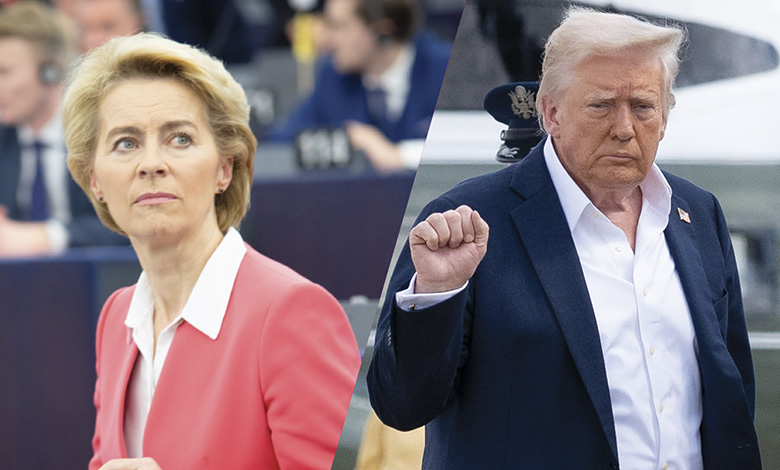

Nearly all EU exports to the US are subject to 15 per cent tariffs from 1 August 2025, after European Commission (EC) President, Ursula von der Leyen and US President Donald Trump signed a wide-reaching trade deal at Trump’s Turnberry Golf Course in Scotland.

With trade in goods and services between the trade blocs surpassing €1.6 trillion in 2024, European leaders are hoping this deal restores stability and predictability for business, while the White House claims the deal “achieves historic structural reforms and strategic commitments that will benefit America”.

Key commitments include:

- Establishing a single, all-inclusive US tariff ceiling of 15 per cent for EU goods. From 1 August, the vast majority of EU goods will be subject to a 15 per cent tariff upon entry to the US market. This includes cars, car parts, and semiconductors. The EC claims that tariffs on pharmaceuticals are also capped at 15 per cent, though Trump has since threatened to impose 250 per cent tariffs on pharmaceuticals. The EC has acknowledged that, “until the US decides whether to impose additional tariffs on these products pursuant to Section 232 [of the Trade Expansion Act 1962] they will remain subject to the US’ most favoured nation tariff”.

- The EU and US will join forces to protect the steel, aluminium, and copper sectors from unfair and distortive competition. According to the EC, the bloc and the US agreed to establish tariff rate quotas for EU exports at historic levels – cutting the current 50 per cent tariff, but the White House have claimed “the EU will continue to pay the 50 per cent tariff”.

- US offers ‘special treatment’ for strategic products. US tariffs on EU aircraft, aircraft parts, certain chemicals, certain drug generics, and “natural resources” will return to pre-January 2025 levels, with a commitment to add more products to this list over time.

- Enabling “better access” to the EU market for US fishery and agriculture products worth €7.5 billion. US exports such as Alaska pollock, pacific salmon, and shrimp, alongside soya bean oil, planting seeds, grains or nuts, ketchup, and cocoa and biscuits will have improved access to the EU market.

- The EU will reduce “non-tariff barriers”. Car/automative standards, and sanitary and phytosanitary measures will benefit from mutual recognition of conformity assessments in additional industrial sectors.

- Large increase in EU investment in US. The EU intends to procure US liquified natural gas, oil, and nuclear energy products with an offtake valued at €700 billion, with the aim of replacing Russian gas and oil. The EU also intends to purchase €40 billion worth of AI chips from the US.

- Promoting ‘mutual investments’ on both sides of the Atlantic. EU companies have expressed interest in investing at least €550 billion in various sectors in the US by 2029, on top of current investments totalling €2.4 trillion.

The fallout

Reaction to the deal has been swift. Hungarian Prime Minister Viktor Orbán said Trump “ate von der Leyen for breakfast”, while French Prime Minister François Bayrou described the deal as a “dark day for Europe”. He lamented: “It is a dark day when an alliance of free peoples, brought together to affirm their common values and to defend their common interests, resigns itself to submission.”

In Ireland, where pharmaceuticals make up 15 per cent of the State’s GDP, Minister of State for International Development Neale Richmond TD said: “We are not exactly celebrating this, it is not a case that this is a good thing but it is probably the least bad option. He continued this tepidity by saying: “It is what it is, and we move on…We want stability for businesses, and we have that today.”

Taoiseach Micheál Martin TD struck a positive tone by saying the deal “brings clarity and predictability to the trading relationship between the EU and the US – the biggest in the world”.

“Given the very real risk that existed for escalation and for the imposition of punitively high tariffs, this news will be welcomed by many,” he added.

Analysis

In an age of political brinkmanship, such negotiations are rarely straightforward. For the US and EU, a long-standing, mutually beneficial economic order was shattered on 2 April 2025, after Donald Trump applied a 25 per cent tariff on all EU exports to the US, leaving European leaders shellshocked.

The ‘transatlantic alliance’, forged in the reconstruction of Europe following the Second World War, risked implosion.

Following the April 2025 development, frenzied negotiations between the world’s largest trading bloc and the world’s most powerful nation bore little fruit, until 1 August – the deadline imposed by Trump against the threat of a 30 per cent levy.

Like a monarch ordering a subject to his palace, Trump beckoned for von der Leyen to meet with him at his golf course in Turnberry, Scotland. There, the two leaders thrashed out a trade deal.

Afterwards, the deal was hailed by von der Leyen as delivering “stability and predictability” to EU-US trade. But to others, it confirmed the observation of former Greek Finance Minister Yanis Varoufakis, that we have now entered a “century of European humiliation”.

EU leaders may take solace in the 15 per cent tariff “ceiling”, but with Trump’s volatile reneging tendencies – vis-à-vis “I’ll end the [Russo-Ukrainian] war in 24 hours” – they may well be thinking, how concrete is this ceiling?

Even more notable is the fact that the EU insists all of this is “not legally binding”.

The EU is certainly splashing the cash, with new investments totalling nearly €1.3 billion (including €600 billion from the private sector), roughly the size of The Netherlands’ GDP, flowing into the US, which, in turn, has committed itself to precisely $0 of extra investment in the EU as part of this deal.

For Trump, this is a major political victory, with the potential prospect of tens of billions of dollars rolling into the US treasury from these tariffs – and to his base, ‘daddy’ displaying dominance over the Europeans – but the €1.3 trillion question is, will American citizens accept higher inflation as the price to pay for Trump’s success?

Suffice to say, with his original 20 per cent, and later 50 per cent tariff proposals, Trump shot for the moon, and even though he missed, with 15 per cent, he certainly orbits the stars.