Construction activity contraction in 2022

Construction activity in Ireland suffered a contraction in 2022, falling below pre-Covid levels of activity amidst increasingly expensive material costs. Despite this, housing completions for the first three quarters of 2022 exceeded completions for the whole of 2021.

Construction output

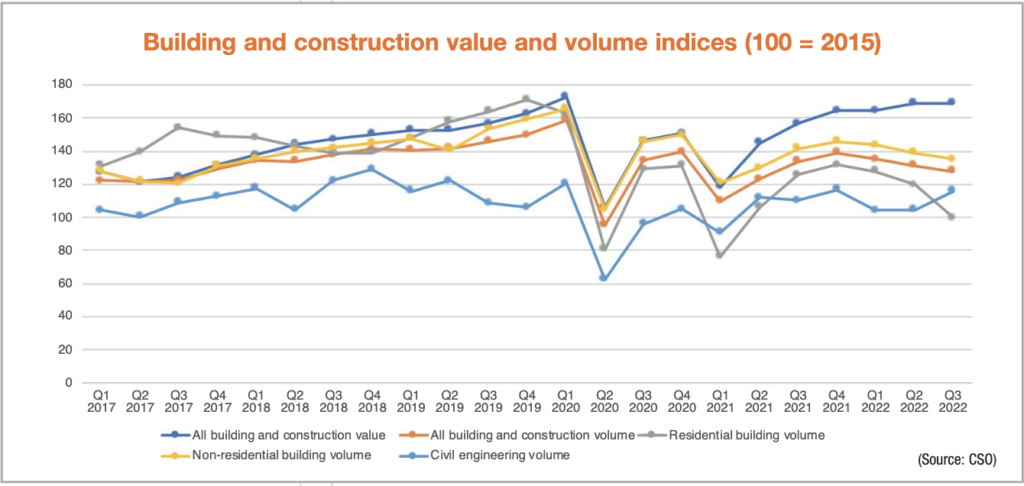

Central Statistics Office (CSO) figures show that the volume of production in construction has fallen by 2.7 per cent on a quarterly basis and 4.5 per cent on an annual basis in quarter three of 2022. This decrease was acutely felt in the residential building sector, where quarterly output declined by 16.2 per cent in a seasonally adjusted volume index. When compared with the pre-Covid index of Q3 2019, Q3 2022 showed a 39 per cent reduction in production in residential building, from 164 in 2019 to 100.1 in 2022. For comparison, Q1 2015 provides 100 for the index.

This drop in the activity index comes despite additional CSO data revealing that new dwelling completions in Q3 2022 had increased by 62.5 per cent on annual basis, with the 20,807 completions during the first three quarters of 2022 – exceeding the 20,560 completions in all of 2021. Completions increased on an annual basis in all categories of dwelling: apartment completions increased by 153.4 per cent; scheme dwellings by 44.3 per cent; and single dwellings by 27.1 per cent.

However, reinforcing the decreasing trend in the construction output index was a reduction in new housing commencements, with Goodbody’s Housing Chartbook reporting that just 1,841 units had been commenced in October 2022, a 31 per cent year-on-year decrease. The report also states that the three months to October 2022 saw apartment commencements fall by 29 per cent and scheme commencements by 23 per cent, with it suggested that “housing output may stall in the mid-20,000s over the next 18 months”, a rate that would be “well short of the Government’s Housing for All target”.

The non-residential building sector also saw its volume of output reduced (although not to the same degree as the decrease in residential building) with a quarterly drop of 2.8 per cent on a seasonally adjusted basis recorded in Q3 2022. The volume of output in the non-residential sector also fell on an annual basis by 4.5 per cent, with the index having fallen by 12.1 per cent since Q3 2019. The civil engineering sector, however, increased by 10.3 per cent on the seasonally adjusted volume index on a quarterly basis, and also recorded a 4.8 per cent year-on-year increase.

In total, the value index for all building and construction decreased by 1.8 per cent on a quarterly basis but increased by 6 per cent on an annual basis. While the production index fell by 12.3 per cent in the pandemic-affected three years between Q3 2019 and Q3 2022, the value index rose by 6.1 per cent over the same period.

Material costs

A possible explanation for the simultaneous fall in production and rise in value can be found in the soaring construction material costs meaning that while fewer projects are being completed, those that are completed have a premium price tag attached to recoup the cost of materials.

Construction Industry Federation’s (CIF) Economic Outlook research determined that 96 per cent of construction companies reported increases in the cost of building materials between June and August 2022, with 85 per cent of respondents stating that they expected the price rises to continue at least until the end of 2022. The cost of materials was cited as the top concern for companies over the period of three to six months following the survey, with 86 per cent of companies citing it as a challenge. Meanwhile, 72 per cent of companies cent cited both access to skilled labour and the cost of labour as challenges, while 69 per cent and 67 per cent cited securing a healthy profit margin and the cost of fuel respectively.

At the time of publication, the CSO’s most recent Wholesale Price Index (November 2022) indicates that almost all building and construction materials have experienced price increases on an annual basis, ranging from the 1.7 per cent increase for ‘other’ metal fittings to the 57.1 per cent increase for fabricated metal. Only lighting equipment saw no change in its price index, and only rough timber and its hardwood and other subcategories saw decreases in price, with hardwood falling by 21.6 per cent. In total, all materials saw an annual price increase of 16.2 per cent, almost double the rate of inflation seen in the second half of 2022, which ranged from 8.2 per cent to 9.2 per cent.

Build 2022

The Government’s Build 2022 report, published in July 2022, notes that construction sector output remains lower than pre-pandemic levels, but that construction client companies had increased their exports by 40 per cent to €2.7 billion between 2018 and 2020, despite the Covid-19 pandemic and associated public health restrictions.

It is further reported that while the Government had aimed to concentrate 50 per cent of housing growth in the five urban centres of Dublin, Cork, Limerick, Galway, and Waterford, 83 per cent of the new dwellings completed in Q1 2022 were in urban centres. This is perhaps explained by the fact that it is the growth in apartment building that is fuelling the increase in new dwelling completions; while overall new dwelling completions rose by 3 per cent between 2019 and 2021, apartment completions rose by 50 per cent.

With trends in construction output still not having matched pre-pandemic levels, the reaching of 2023’s Housing for All targets looks to be under threat, with a further challenge being that of inactive planning permissions; the Housing Supply Task Force report for Q4 2021 showed there to be 74,879 homes in Dublin to have received planning permission, with 48,032 of them unused. Dublin Democratic Planning Alliance data showed there to be 39,823 homes with unused planning permissions under the Strategic Housing Development process in February 2022. Build 2022 states that there are between 70,000 and 80,000 homes with planning permission that have not commenced construction. Combatting the looming stagnancy predicted in the construction industry will require the activation of these dormant permissions, with the Government stating that its Croí Cónaithe (Cities) scheme will go some way in meeting this challenge.