‘Substantial’ north/south goods trade growth since Brexit

North/south goods trade has grown “substantially” since Brexit, a report by the Economic and Social Research Institute (ESRI) has found, with the Republic now accounting for over half of the North’s exports.

The substantial growth in the cross-border goods trade has seen the Republic of Ireland record €160.3 billion in goods exports and €99.8 billion in goods imports in 2021, while the North recorded totals of €10.5 billion in goods exports and €7.6 billion in goods imports, with this figure not including imports from and exports to Britain, which is not classified as international trade.

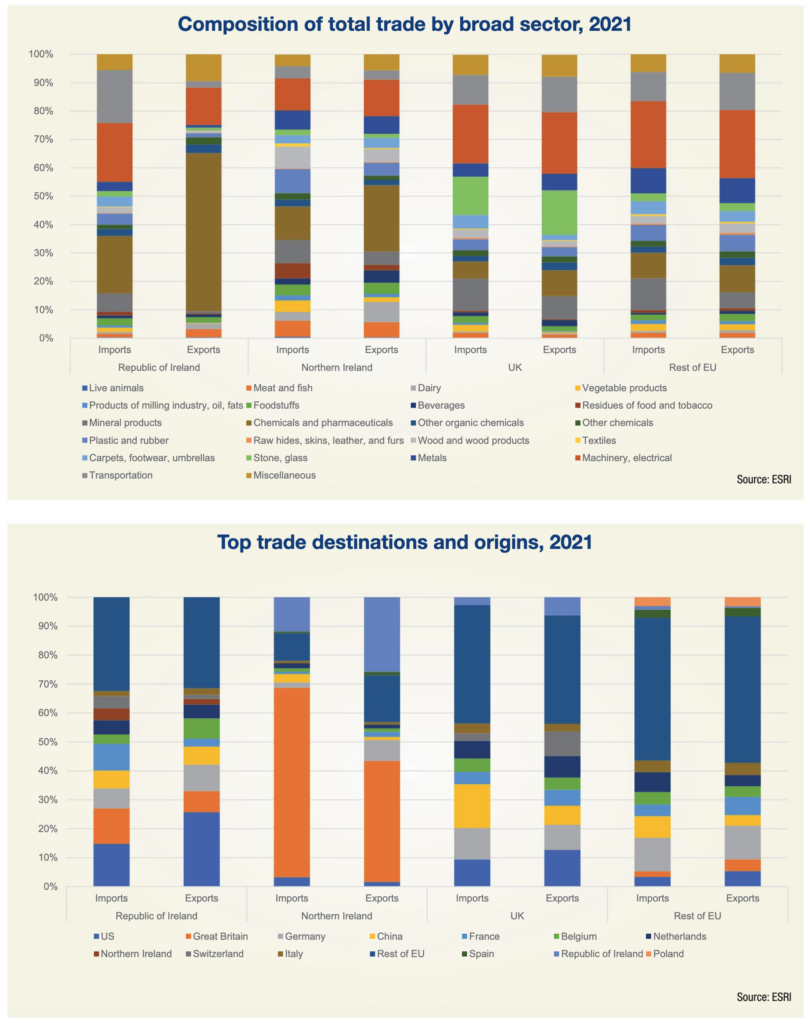

Most notable within the findings is the reassertion of the importance of cross-border trade to both economies, especially that of the North, in the wake of Brexit. In terms of total trade, the Republic accounted for 11.93 per cent of northern imports and 28.58 per cent of exports, making it the second most popular locations as both a destination and origin of trade behind only Great Britain (65.49 per cent of imports and 46.38 per cent of exports).

When trade with Britain is excluded, the Republic accounted for 53 per cent (€5.6 billion) of the North’s goods exports, and 35 per cent (€2.6 billion) of its goods imports, making it the North’s largest trading partner classified as international trade.

The “most striking difference” between the Republic and the North, “and indeed to the rest of the EU” is the dominance of the US as both an import and export partner for the Republic. The US accounts for 31 per cent of Irish exports and 17.01 per cent into the Republic, with Britain second accounting for 14.15 per cent of imports and 8.84 per cent of exports, shares that “have reduced considerably in the aftermath of Brexit relative to the historic patterns of trade between the two countries”.

Having increased its share of the Republic’s imports from 1.5 per cent to 5 per cent in the first six months following Brexit, the North accounts for 4.71 per cent of southern imports and 2.29 per cent of exports, “sizeable shares given the much smaller size of the Northern Ireland economy relative to the other top 10 partner countries”.

The ESRI’s research, published in a paper titled Structure of International Goods Trade for Ireland and Northern Ireland, is notable because it is the first of its kind to include export and import data for Northern Ireland on product and market level, which first became available in 2021. The availability of this data allowed the ESRI to “examine how the structure of cross-border trade looks relative to Ireland and Northern Ireland’s trade with other trading partners” and overcomes previous limitations of trade flows being studied in isolation rather than the broader context of aggregate trade structures.

At the sectoral level, both sides of the border show a reliance on the chemicals and pharmaceuticals sector, which accounts for 55.7 per cent of the Republic’s exports and 20.2 per cent of its imports, the second largest import sector just behind machinery and electrical (20.7 per cent). Chemicals and pharmaceuticals are also the largest export sector in the North, accounting for 23.4 per cent, and the largest import sector, accounting for 11.8 per cent. These figures are not in keeping with either the UK or the rest of the EU: in the UK, chemicals and pharmaceuticals account for 6 per cent of imports and 9.1 per cent of exports; in the rest of the EU, they account for 9 per cent and 9.6 per cent.

“Cross-border trade looks quite different in both directions to the aggregate trade structures” of both jurisdictions, the ESRI notes, a fact which mainly “comes about from a much greater variety of goods being traded cross-border relative to the more specialised patterns of overall trade, in particular exports”. Food and beverages as a sector “accounts for a considerably larger share of cross-border trade than it does in the overall trade sector”, making up 24 per cent of goods going north from the Republic and 27 per cent of goods going south from the North.

“Looking at openness and product range, we find that the values of overall goods trade are roughly in line with the sizes of the two economies,” the report states. However, the range of product–partner country combinations in both jurisdictions are “below the usual level observed in other countries of comparable size, reflecting the degree of specialisation in both trade structures – mainly on the partner country dimension for Northern Ireland and the product dimension for Ireland.”

With both economies firmly aimed at the development of export-heavy industries, the ESRI says that cross-border trade can “play a role as an accessible first step into broader exporting and, hence, a greater degree of information on these flows and on how they compare to trade with other markets nay help in the development of such policies”.