Nursing and midwifery regulation in a time of change

The Nursing and Midwifery Board of Ireland (NMBI) maintains the largest register in healthcare, with 76,000 registered nurses and midwives. Nurses and midwives make up a third of all the healthcare staff in Ireland. There is no doubt that nurses and midwives will play a pivotal role in the overall direction of travel for healthcare in Ireland in the coming years, writes new NMBI CEO Sheila McClelland.

Changes in healthcare

We are already seeing the emergence of big changes at the European and national level, such as:

• in the nursing and midwifery workforce itself;

• ageing populations with more complex needs and multi-morbidity;

• re-imagined healthcare models and reconfigurations, such as Sláintecare; and

• technological developments.

Clearly nursing and midwifery are going to be impacted hugely. Nursing regulation also has to keep up, protecting the core missions of patient safety and the integrity of the professions of nursing and midwifery.

How does NMBI, as the nursing and midwifery regulator, prepare for the changes and challenges?

We need to deliver, and continually improve on our statutory obligations. These are maintaining a Register of Nurses and Midwives; setting standards for Higher Education Institution nursing and midwifery courses; setting professional standards for nurses and midwives; and considering complaints against nurses and midwives who practise in Ireland. But there are also challenges.

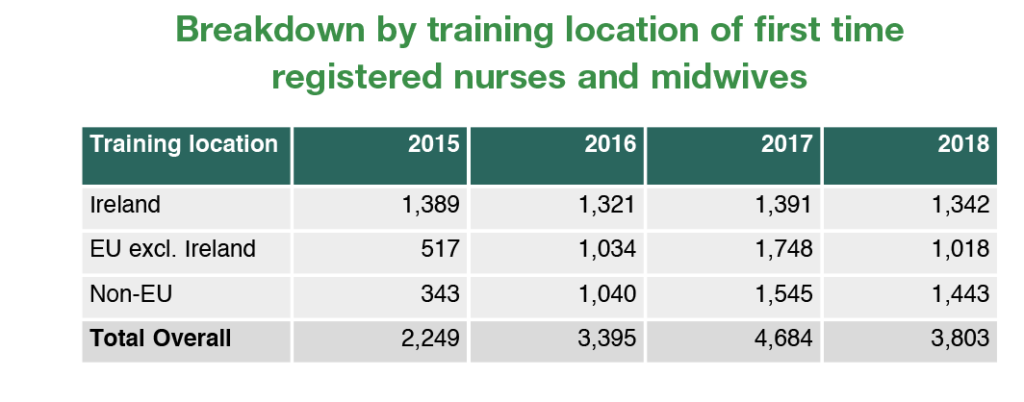

Register of nurses and midwives and a global workforce

We have experienced an increase in the number of applications, and first time registrations, from overseas nurses and midwives in recent years. This has implications as much more work is involved in assessing these applications, with multiple processing steps to ensure recognition of qualifications, verifying transcripts and experience, and because there may be requirements for periods of adaptation in Irish healthcare settings to ensure applicants meet the standards and requirements for registration.

Nursing and midwifery education

We will focus considerable time and effort on future-proofing nursing and midwifery education and standards, to ensure nurse and midwives have the correct skills and competences. We need to do this because we now know at a national and European level that there will be more emphasis on community based care, preventative care, multi-disciplinary teams, changing roles and decision making rights, technology adoption, revalidation and continuous professional development.

Fitness to practise

Considering complaints against nurses and midwives is always serious. It is a time of anxiety if there is a complaint about you as a nurse or midwife, or if you are making a complaint about the practice of a nurse or midwife. We are very aware of the impact that being involved in a complaint has, and NMBI staff try to guide people through the process with sensitivity. We will continue to be empathetic to the needs and expectations of both complainants and registrants. We recognise the need to get quicker at undertaking initial investigations, and progressing and completing the entire process. New legislation will help us deal with cases more expeditiously and we are putting in place a range of measures to realise improvements regarding timelines.

Complaints

Fear of legal action, litigation, and insurance costs, can discourage candour, but if we think back to our mission, we need to learn from mistakes in order to improve patient safety outcomes. In light of recent developments in healthcare, there is now more reflection about whether there are better ways to deal with complaints. The Professional Standards Authority in the UK has been leading the way on this issue of what to do when something goes wrong, by looking at what regulators can do to embed a culture of candour. The regulators in the UK signed up to a statement in 2014 to encourage candour, and in the recent review we see that they have made progress in encouraging candour amongst their registrants since then.

NMBI: Planning for change

For us in NMBI, we need to be prepared for changes and we need to be agile in our response to them, but it cannot just be rhetoric: it has to be real and tangible. Those working in nursing and midwifery, and patients, need to see and feel it.

We are currently in the process of finalising our strategy for 2020-2022. This will set the direction for NMBI and nursing regulation for the next three years. It will have specific, associated yearly work programmes, to deliver on our role amidst all the changes and to respond to those changes.

Contribution to policy: data, research and evidence

It is important to emphasise that you cannot plan for the future without having an evidence base and data, and you cannot plan for the workforce of the future in healthcare without ensuring nurses and midwives have the right education and training.

We can all see the data gaps at this stage. In 2018 alone, we saw it with the Public Pay Commission for its report, the data limitations identified in the Health Service Capacity Review, and the recommendations by the Taskforce on Staffing and Skill Mix for Nursing about the need for more data, more evidence and frameworks.

Workstream Three of Sláintecare is, of course, looking at workforce planning, new ways of training and the teams of the future. NMBI is gearing up and preparing to develop and maximise our contribution to the big policy debates. We can do that by providing the evidence base and data for registered nurses and midwives working in Ireland. Here is where NMBI has a huge role to play, in collaboration with our other regulation colleagues, policymakers, nurses and midwives, and the public.

Our new digital system which will assist with all of this is under development. In making this investment we need to be sure that we are future proofing the Register, and the information we are holding on the Register.

NMBI Strategy 2020-2022

As part of our new strategy:

• Our new digital platform will capture the required data for all registered nurses and midwives;

• We will work with stakeholders to develop a regulatory framework that reflects the multi-disciplinary models of healthcare envisaged under Sláintecare while also ensuring that nurses and midwives’ scope of practice remains understood, defendable and safe;

• We will continue to regularly review our code, education standards, and guidance, to ensure they remain relevant to what nurses and midwives are experiencing on the front-line; and

• We are going to streamline the process of engaging with NMBI for nurses and midwives, allowing them to pay online, giving easy access to records and data, and enhanced self-service.

At the end of the day, patient safety is what drives the NMBI. There needs to be an evidence base to what we do regarding policy, and we need to be linked and fully integrated with the rest of the healthcare system and other regulators. The changes are coming and happening, and we need to be responding, to ensure nursing and midwifery can fully develop and expand as professions, and nursing regulation remains relevant.

T: 01 639 8500

E: communications@nmbi.ie

W: www.nmbi.ie