Transdev awarded key energy certification

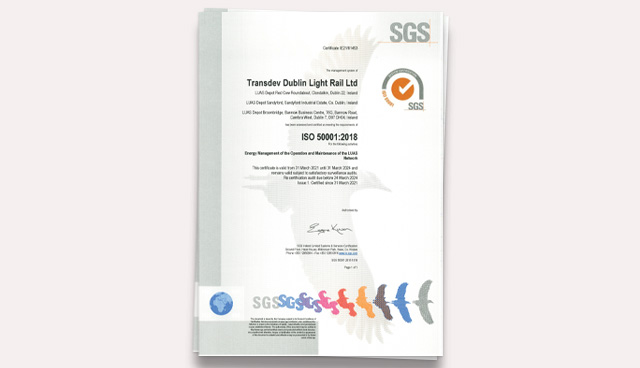

Transdev Dublin Light Rail (TDLR) was awarded certification in ISO 50001 — Energy Management by SGS, the first time Luas, Dublin’s light rail network, has achieved this standard.

Moving You strategy

Seamus Egan, Managing Director, said: “Achieving this certification in 2021 is even more rewarding for Transdev in Dublin as it embodies our global strategy which is referred to as Moving You.” This strategy is based around five pillars:

- People;

- Performance;

- Innovation;

- Customers; and

- Clients and Communities.

Eoghan Sweeney, Chief Performance Officer, also commented on the day of the award: “This day is 15 years in the making and it is teamwork which got us here today. This certification not only shows our commitment to our client, Transport Infrastructure Ireland, but also the wider community, Luas commuters and Dublin City.

“The energy projects which we intend to work on will be innovative and lead the way, all as part of Transdev’s Moving You strategy.”

Sweeney continued: “As ISO 50001 is the energy management standard that is recognised worldwide, it enables us to demonstrate our commitment to energy improvement and to demonstrate we are top in class when it comes to energy management. Very importantly, it also makes a significant contribution to achieving Ireland’s carbon reduction goals.”

Transdev Dublin Light Rail (TDLR) was certified to ISO 50001 on 31 March 2021.

Transdev’s commitment

TDLR has committed to a reduction in greenhouse gas emissions of 30 per cent and a 32.5 per cent improvement in overall energy efficiency by 2030. This will represent an important contribution to the Irish Government’s targets in this area.

How will Transdev achieve this?

TDLR has undertaken a full review of operations and maintenance and compiled a list of opportunities for improvements within the most energy-intense processes in the business. A feasibility study is now completed for any potential projects identified. Project teams are now formed to get the projects implemented as efficiently as possible.

Discussions are being held with the wider teams in TDLR on an ongoing basis to identify future energy efficiency projects that will help TDLR to achieve the ambitious targets it has set for 2030 and beyond. Detailed in this article are but some of the projects being considered or commenced.

“As ISO 50001 is the energy management standard that is recognised worldwide, it enables us to demonstrate our commitment to energy improvement and to demonstrate we are top in class when it comes to energy management. Very importantly, it also makes a significant contribution to achieving Ireland’s carbon reduction goals.”

— Eoghan Sweeney, Transdev Chief Performance Officer

Energy monitoring system

TDLR is nearing completion of the installation of a new energy monitoring platform to enable the proactive monitoring of energy consumption for all operations. This will reduce reliance on our current system, and it will allow live proactive energy consumption monitoring at any location on the network. In the event of an energy spike

or metering point going offline, we will be notified within 15 minutes of this allowing for proactive investigation and repair, reducing the potential for lost data and spikes in energy consumption. This will also enable us to identify, implement and complete other energy efficiency projects, and accurately track and validate energy savings that will contribute to our overall energy consumption reduction targets in 2030 and beyond.

LED upgrade

We are currently trialling LED retrofitting on trams to allow for better lighting for staff and customers. We are also rolling this out in Luas depots, including street lighting along the whole Luas network. This will allow for a better aesthetic feel for everyone using the Luas network.

Heating and ventilation modification

TDLR is currently completing a trial on the heating and ventilation systems on trams. This should enable a 40 per cent reduction in energy consumption, and simultaneously it will help improve customer comfort on the tram.

Testing is also taking place on a new tram monitoring system that will enable us to identify other high energy consumers and look at more energy efficient alternatives.

Eco driving

We are exploring the benefits of incorporating eco driving along the Luas network, based on some promising results from other Transdev operations. This will tie in nicely with the rollout of our energy monitoring systems to see what savings are achieved from this initiative.

Solar PV

We are currently looking at installing solar PV in Luas depots. This will enable us to reduce our dependence on fossil fuel alternatives. This is another project that we can feed into our energy monitoring platform. It will allow us to see what we are generating each day and will prompt future improvements.

Depot heating

We are also looking to improve the heating system in our maintenance areas. As can be imagined, these are large open areas that are difficult to heat as once doors are opened to let a tram in or out much of the heat also escapes. An innovative solution will be required to get a much better system in place that can operate to our needs but also contribute to our energy efficiency targets.

Commenting on these initiatives Seamus Egan, MD of TDLR said: “As you can see some of these projects that we are working on are simple in nature but the energy savings from implementation will be very effective. These projects will be the cornerstones of what will be the start of a long process in overhauling what is in place currently but in doing so will ensure we have a sustainable business that is a leading light for our staff and customers every day.”

T: +353 (0)1 461 49 10

E: info@luas.ie

W: www.transdevireland.ie