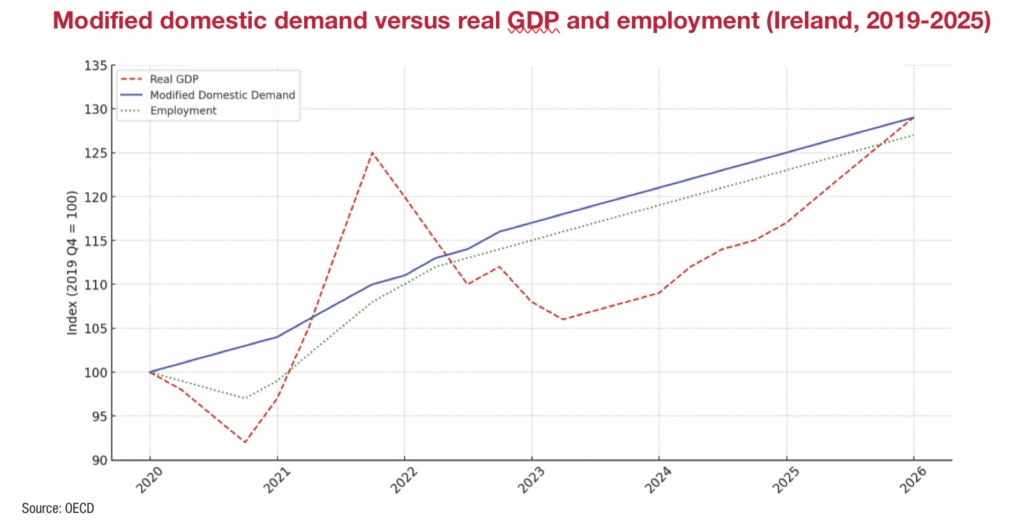

Ireland’s strong economic fundamentals continue to support resilience and growth in the face of international uncertainty, according to the OECD Economic Survey of Ireland 2025, which presents a mixed picture of remarkable performance and persistent structural vulnerabilities.

The biennial report, published in February 2025, outlines robust labour market conditions, ongoing fiscal strength, and opportunities for long-term reform in housing, climate policy, and taxation.

“Despite several major shocks, Ireland has raised its economic performance and standard of living over recent decades”, the OECD says. A stable institutional framework, a well-educated workforce, and a supportive business environment have underpinned success, attracting significant foreign direct investment.

However, the survey also underscores pressing challenges that threaten to erode this progress if left unaddressed. Chief among these are Ireland’s high housing costs, fiscal reliance on a narrow corporate tax base, and lagging progress toward ambitious climate goals.

While Ireland’s public finances are currently in “good health”, the OECD warns that “fiscal restraint is called for in the near term”, especially in light of capacity constraints and inflationary pressures. Public debt, though low at 43.2 per cent of GDP in 2023, remains significant when measured against modified gross national income (GNI*), reaching 76 per cent.

While Ireland has benefited from windfall corporate tax revenues, the OECD cautions: “Around one-third of income earners do not pay personal income taxes or the universal social charge… While the standard value-added tax rate is high, reduced rates decrease its yield.”

The report stresses the importance of improving medium-term revenue resilience, advising that Ireland “develop a roadmap to diversify tax revenues in the medium term, for example by broadening the personal income and the value-added tax bases”.

To enhance fiscal credibility, the OECD recommends making the existing domestic spending rule more binding: “Recurrent breaches of the domestic spending rule are lowering its [ability to] establish more binding fiscal guardrails to complement the new EU rules, with stronger political anchoring and well-defined escape clauses.”

Cost of labour

Ireland’s labour market continues to post record performance. “Employment reached a record high in the third quarter of 2024… the unemployment rate remains near historical lows.” However, the report notes that “firms cite skills and labour shortages as a main concern”, which could limit progress on green and housing investments.

High childcare costs continue to dampen labour participation, especially among women. “Despite marked increases in childcare subsidies, the high cost of childcare creates disincentives for some groups of women to enter work or work more hours.” The OECD recommends “making public financial support for childcare more means-tested and couple it with continued measures to expand childcare capacity”.

Challenges on rising legal and administrative costs are also flagged. “Lengthy court proceedings… and high legal costs, especially of litigation, can also reduce competitiveness.” The OECD calls for competition-enhancing reforms: “Enhance competition in legal services by easing the setting up of multi-disciplinary practices with a Limited Liability Partnership status.”

Housing

Housing remains one of the State’s most pressing challenges. “High housing costs could lower the attractiveness of Ireland for foreign direct investment and talent,” the Survey states. While the Government’s Housing for All plan has spurred increased completions, “supply-demand mismatches persist”.

The OECD urges a “more dynamic, data-driven” approach to housing targets: “Ensure housing targets reflect housing needs accurately through regular updates and better align local targets with local conditions, especially in urban areas where housing shortages are more acute.”

Construction costs are cited as a major barrier. “Costs are high and productivity is low in the construction sector, notably for apartments in urban areas.” Among the recommendations is the implementation of the 2023 Residential Construction Cost Study, including reforms to unit specifications and wider adoption of standardised building methods.

On social housing, the OECD notes that “the system is characterised by increasing costs and dependence on housing allowances and the private sector rental market”. The report calls for a funding reform to allow “a switch of some social transfers to the construction of social or affordable housing”.

Climate and energy

The survey delivers a stark warning on climate: “Ireland is not on track to meet its 2030 greenhouse gas emission targets and needs to make faster progress in putting emissions on a sustained downward trend.” Despite an established framework, the OECD stresses that “a shift from planning to implementation, focusing on delivery of concrete actions, is needed”.

Among the more urgent measures is harmonisation of carbon pricing: “Carbon prices are highly uneven across sectors, reducing incentives to reduce emissions.” With fossil fuel subsidies totalling €3.5 billion in 2022, the OECD recommends to “further align carbon prices across sectors in line with their environmental impacts and phase out fossil fuel and other environmentally harmful subsidies”.

Ireland’s electricity infrastructure also needs urgent attention. “Electricity demand is rising… requiring an acceleration of renewables. Faster permitting and grid connection processes, and upgrades in transmission, distribution, and storage infrastructure are needed.”

The survey concludes with a forward-looking vision: “Maintaining stable growth and high living standards… requires policies to address challenges due to population ageing, ensure adequate supply of affordable housing and combat climate change.”