Post-Brexit damage

The first comprehensive long-term post-Brexit outlook for the Irish economy commissioned by the Department of Finance has been published and represents bleak reading.

The paper by the Economic and Social Research Institute (ESRI) provides analysis of the complete macroeconomic impact of Brexit on Ireland under three alternative scenarios, focusing on the period after Britain’s projected departure from the EU in 2019.

Unlike previous studies, which have considered the short-term impact of the uncertainty surrounding Britain’s chosen Brexit model and the impact on individual channels such as FDI or trade, the study considers the combined effect of all channels as well as feedback and indirect effects via other trading partners and assumes that tariffs and other trade restrictions will apply immediately upon Britain’s exit.

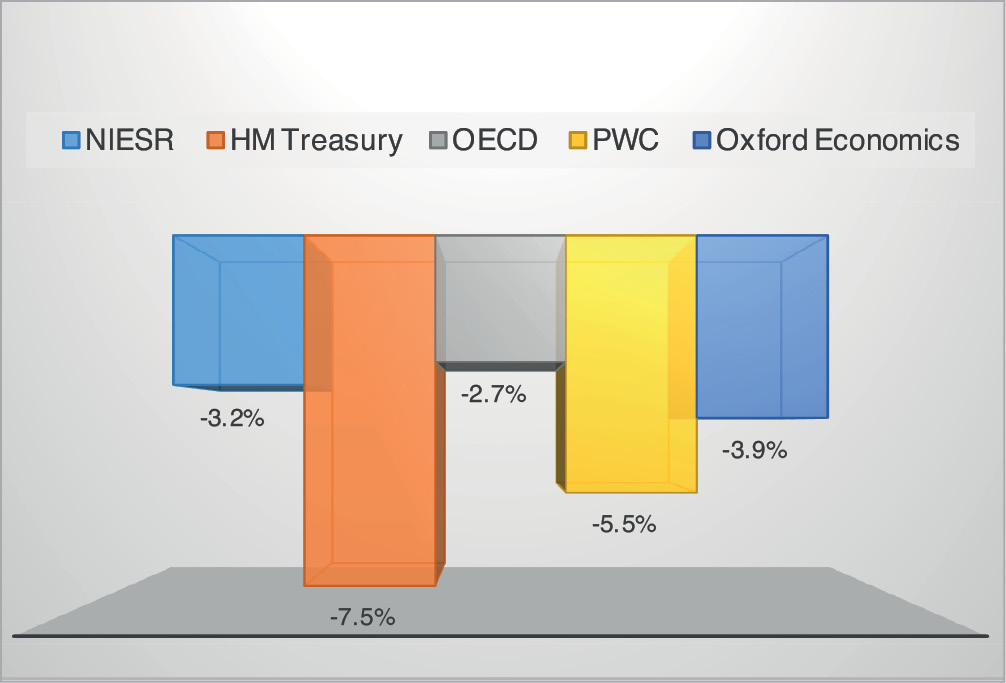

The study uses a COre Structural MOdel of the Irish economy (COSMO), to assess the macroeconomic impact under the three different scenarios identified by the UK’s National Institute of Economic and Social Research (NIESR). Using NIESR’s modelling, the study includes the impacts on other countries due to Brexit, which will influence the position of Ireland’s trading partners.

The three scenarios outlined are:

- a Norwegian-type solution whereby the UK becomes a member of the European Economic Area (EEA);

- a scenario based on the UK agreeing a bilateral trade agreement with the EU along the lines of the EU/Swiss trade agreements, where trade in services is not free; and

- the UK and EU not concluding a bilateral trade agreement and instead, the UK exercises its rights under the Most Favoured Nation (MFN) clause of the World Trade Organisation (WTO).

Applied to the UK, results have shown that under EEA, EFTA and WTO scenarios trade between the UK and the EU is assumed to be reduced by 23 per cent, 31 per cent and 50 per cent respectively and DFI inflows into the UK are expected to be down 9.7 per cent, 17.1 per cent and 23.7 per cent.

“The results show that, depending on the scenario, the level of long-run UK GDP would be reduced by between 1.8 per cent and 3.2 per cent and the level of wages would be reduced by between 2.7 per cent and 5.5 per cent.”

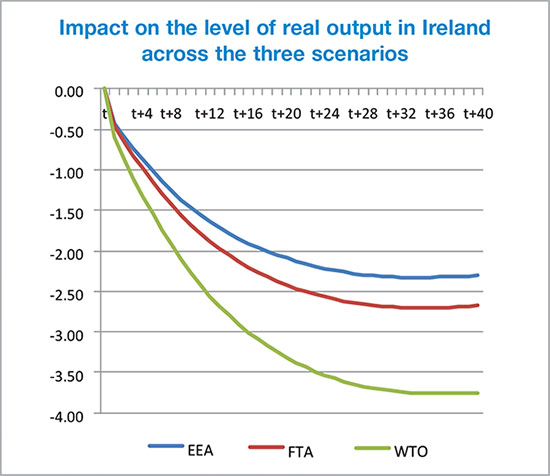

When the three scenarios are applied to the Irish economy, the report found that “in each scenario, the level of Irish output is permanently below what it otherwise would have been in the absence of Brexit”.

Impact on the level of real output in Ireland across the three scenarios

The most significant factor is a drop in demand for the trade sector, stemming from a shortage in export demand from the UK.

The report states: “The shock to foreign demand would reduce the volume of output in the traded sector and exports over the medium to long-run below their baseline values. The fall in traded sector output leads to labour demand being below base which has knock-on effects for employment and the unemployment rate. As a result of the loosening in the labour market average wages are lower than in the base. The combination of lower employment and lower wages leads to lower personal income and consumption. As a result, activity in the nontraded sector which is driven by domestic demand is below base.”

A fall in output and employment is also likely to drive reduced government revenue from taxes, while the increase in unemployment will necessitate greater government spending on welfare.

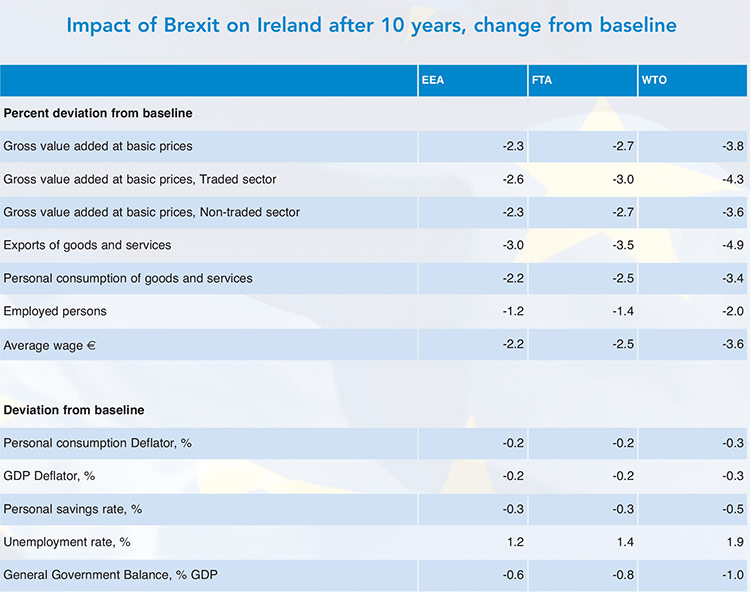

A ‘hard’ Brexit scenario is predicted to increase unemployment by 1.9 per cent, reduce GDP by 3.8 per cent and reduce the average wage by 3.6 per cent.

If the UK chooses to join the EEA, unemployment will decrease by over 1 per cent, GDP will be reduced by 2.3 per cent and the average wage will be 2.2 per cent lower than it would have been without Brexit.

A Free Trade Agreement scenario would see GDP drop by 2.7 per cent, unemployment would be 1.4 per cent higher and the average wage would be 2.5 per cent lower.

Concluding on its findings, the report says: “There is almost a complete consensus in the existing literature that Brexit will have a negative effect on the UK economy both in the short-term (via uncertainty) and over the medium-to-long term (via trade, FDI etc,). The UK is one of Ireland’s closest economic partners and, as such, Ireland will be very exposed to the effects of the UK leaving the EU. There is considerable uncertainty surrounding the eventual agreement between the UK and the EU. As a result, many of the existing international papers that model the effects of Brexit consider several scenarios that cover the range of potential outcomes.

“To model the potential effects of Brexit on the Irish economy, we draw on the international literature and use the scenarios developed by NIESR to create alternative international scenarios for Ireland. These international scenarios are incorporated into the new COSMO model of the Irish economy in order to quantify the potential impact of Brexit. The results of the modelling exercise confirm some international analysis (e.g. Schoof et al, 2015) that Ireland will be particularly badly impacted by Brexit. Depending on the scenario considered, the level of Irish output ranges to between 2.3 and 3.8 per cent below what it otherwise would have been.”